Spoilers ahead.

At the risk of ruining the suspense for you, we will just come forward and admit from the get-go that nothing good happened last week. As hard as we tried to unearth what could pass for good news, we just couldn’t find any. However, in our defense, the bad, the ugly and the scary doesn't quite have the same Eastwood-ian ring to it.

What follows is a brief rundown of the past week’s events.

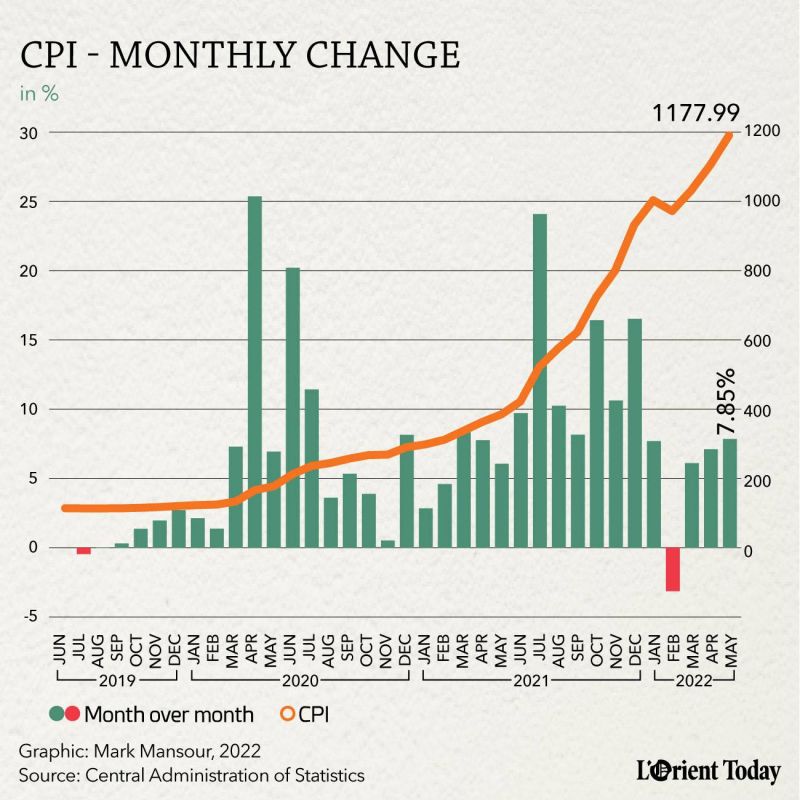

The Central Administration of Statistics reported that general prices increased 211.43 percent since last year. However, since October 2019, prices have increased more than tenfold as the lira lost more than 90 percent of its value. This is the bad part. But the fact that private sector representatives agreed last week to recommend raising the minimum wage by a meager LL600,000 to LL2.6 million is the ugly bit.

If enacted by the cabinet, this would be the second increase from the pre-crisis number of LL675,000 only two years ago — the first one was by a decree issued in May raising the monthly minimum to LL2 million — but bear in mind that 20 liters of gasoline currently sell for LL700,000, and as soon the subsidies are fully removed the price is estimated to reach LL800,000. In addition, the new telecom tariffs will kick in next month, and it would be safe to assume that people will be paying on average LL500,000 to LL600,000 for their mobile bill, excluding internet and fixed line fees. And voilà half of the salary is already gone.

Now, we come to the scary part: Private sector wages may have inched higher but public sector employees’ salaries are still frozen in time. Employees are still being paid as if it is still 2019, and although the government approved the disbursement of some financial assistance, to be set at between LL2 million and LL6 million for public employees; however between delays in approving the 2022 budget and the capriciousness of the central bank, payments have been inadequate and few and far between. The race to the bottom has another year to go, as half of the public institutions say they won’t last more than 12 months; if current trends continue, they might shut down completely, being unable to pay for operational expenses.

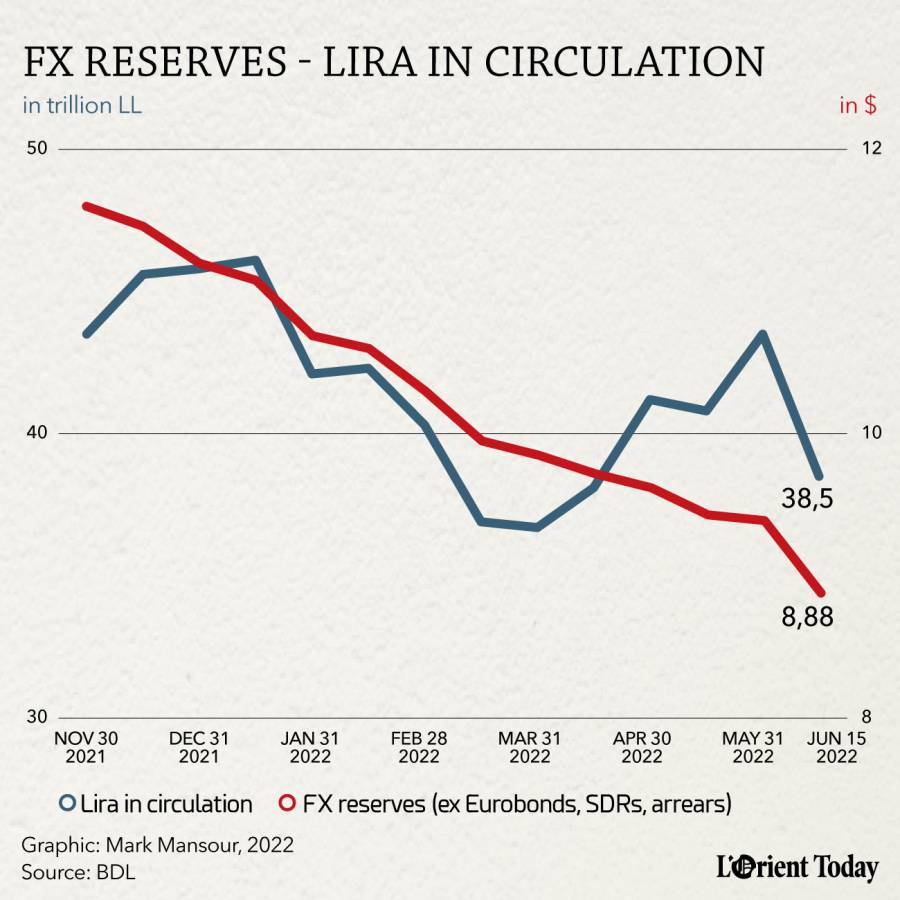

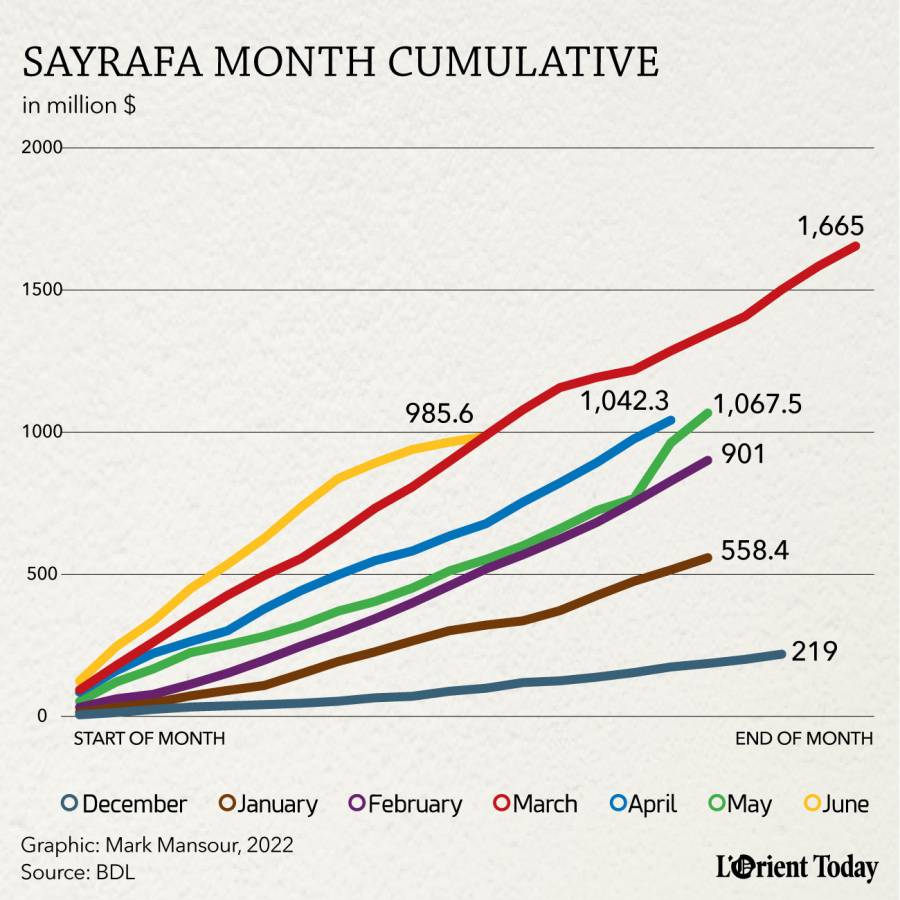

And since we are on the topic of the central bank, BDL’s bimonthly balance sheet revealed that another $500 million from the foreign currency reserves (depositors’ money) have gone down the drain in the first half of June alone. The lira continues to defy laws of gravity, trading between LL27,000 and LL28,000 to the US dollar. This is the bad part. But when it hits you that the central bank in two weeks only spent more than 5 percent of our remaining cash, then you realize how ugly the situation is.

Perhaps, we need to stop dwelling on the past, or what finance people call sunk costs, but the damage is not limited to the $500 million; it is the $2.5 billion since December, the $6.5 billion since June last year and the whopping $12 billion since October 2019.

You may be wondering what could be uglier than those numbers — simply, the fact that we haven’t made one iota of progress on the reforms required by the International Monetary Fund. No reforms means no trust and no money, and no trust means no turnaround, and off we go perpetuating the same cycle of destructive policies. We heard the reason the Energy Minister extended the deadline for applications to conduct offshore drilling is that no one applied. Circumstantial evidence!

For the last part let us just cut the niceties and go straight to the point. Outbreak of Hepatitis A, and there are no vaccines; wheat shortages forcing people to buy bread in the parallel market at double the official price. If you are still wondering, this is where the other half of the private sector wages goes, to basic food items.

And if you still require proof that the situation is beyond scary, the UN is extending its emergency plan for Lebanon, estimating that as many 2.2 million Lebanese citizens are in need of emergency humanitarian aid and furthermore results from a survey conducted by the American University of Beirut revealed that people are “changing their diet, skipping meals, postponing doctors’ appointments, reducing use of hot water, reducing use of a vehicle, spending out of savings and withdrawing from education” to cope with the current crisis.

Changing the name of this newsletter to “Doom and Gloom from Beirut” should be next on the editorial team’s agenda.

Don’t forget to follow next week our coverage of the parliamentary consultation to name a new premier designate. If it were legal, we would have started taking bets on everything and anything related to the post-election period: time to designate a prime minister, time to form a government and, most importantly, time to elect a new president.

Until next week.