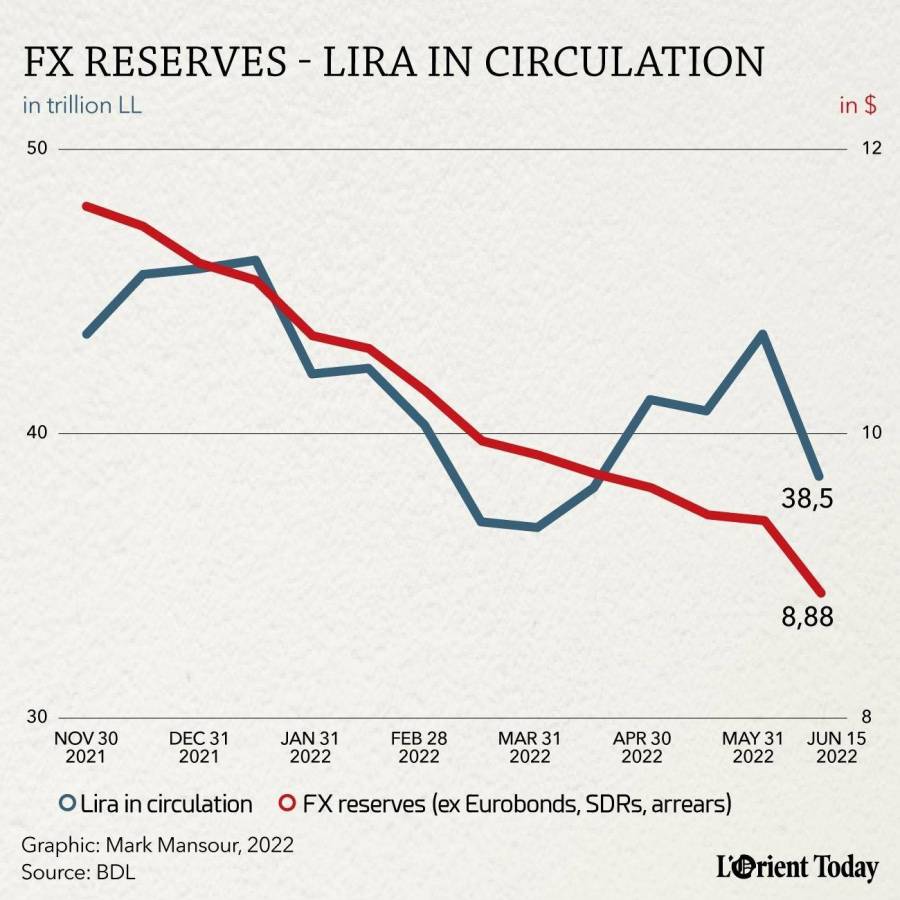

BEIRUT – Lebanon’s central bank spent $500 million from its foreign reserves in the first 15 days of the month of June in a bid to stabilize the Lebanese lira.

The bimonthly balance sheet published by Banque du Liban, revealed that gross foreign reserves at the central bank dropped from around $16 billion at the end of May to around $15.5 billion on June 15.

The foreign assets reported includes $5.03 billion in Lebanese Eurobonds, around $1 billion in Special Drawing Rights and around $500 million to $600 million in unpaid bills to importers. The final adjusted number should be closer to $9 billion.

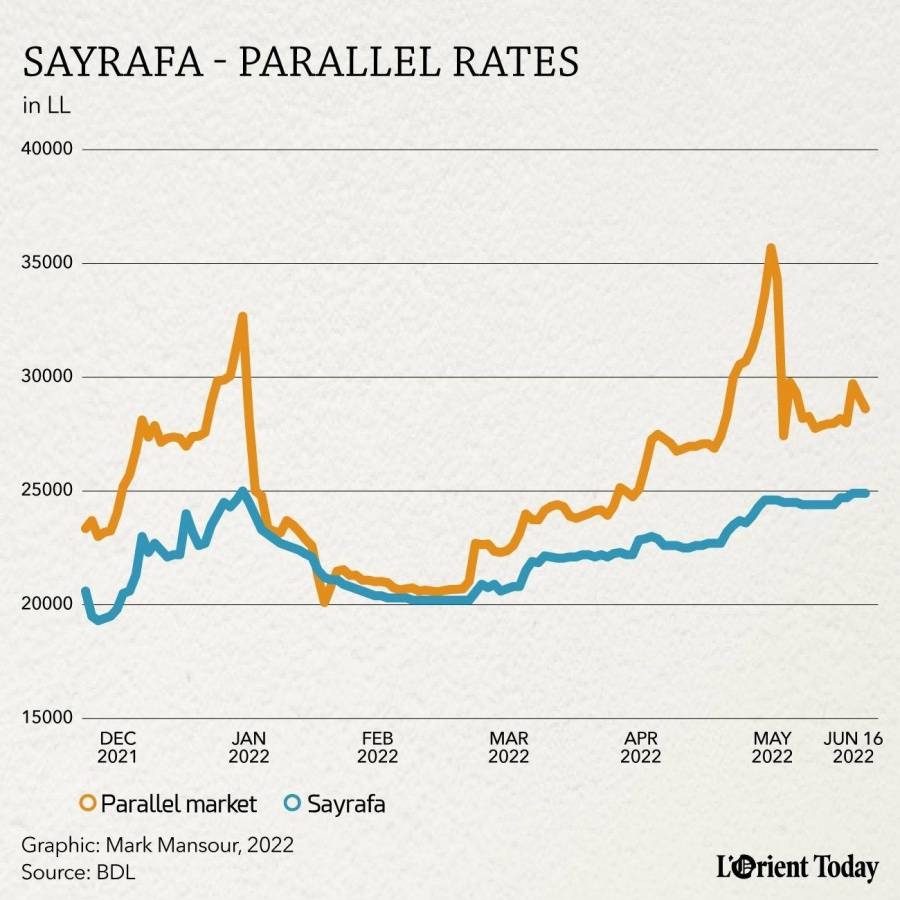

The central bank used up more than $2.5 billion of its reserves since mid-December when Circular 161, which allows commercial banks to sell unlimited dollars to clients at BDL’s Sayrafa platform rate, was first released. However, the lira continues to trade at the same level on the parallel market as it did in mid-December: LL27,000 to LL28,000 to the US dollar.

The central bank has made repeated attempts to reaffirm its commitment to its strategy of selling unlimited US dollars to commercial banks. The latest was on May 27 after the lira dropped to the all-time low of LL38,000 to the US dollar.

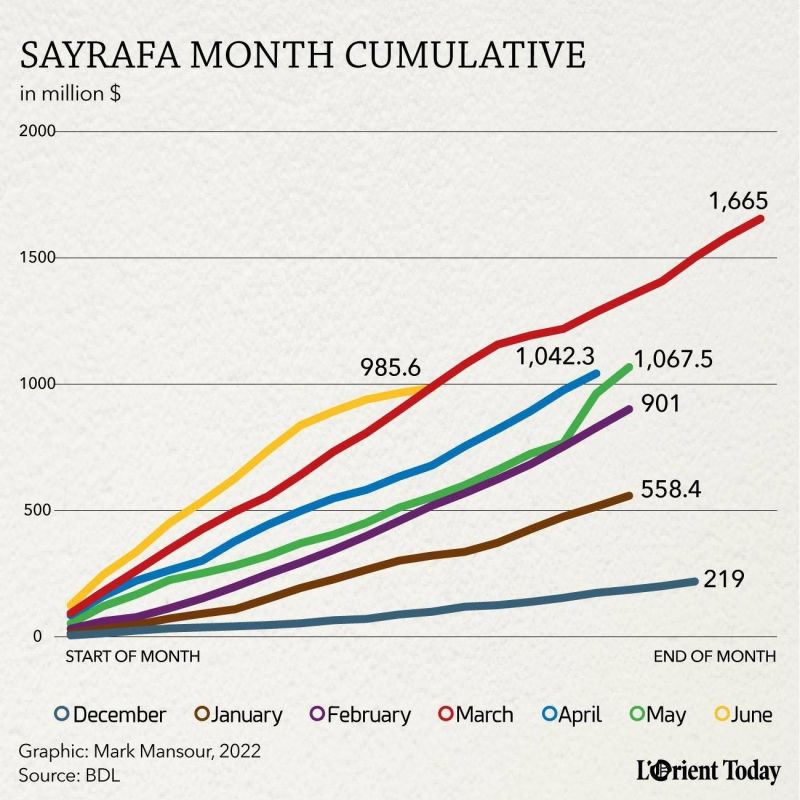

In the days following May 27, the Sayrafa platform recorded increasing dollar volumes, at one point approaching $200 million per day. However, the initial surge slowed to a halt, as the platform recorded only $20 million on June 16.

The drop in volume is attributed to the many restrictions banks imposed on clients looking to convert at the favorable Sayrafa rate, which has been trading around 15 percent stronger than the parallel market rate in recent weeks. Banks told L’Orient Today that they were forced by the central bank to set a limit of up to $500 per client, on top of other requirements such as account size, proof of funds, and salary domiciliation (proof that salaries are kept in the bank).

Total volume recorded on the Sayrafa platform in the first 15 days of June is nearing the $1 billion level. One reason why the central bank could have reduced the amount of dollars it injected is if the current transactions continued at the same pace then the total volume for the month could reach $2 billion. The highest reading registered so far was recorded in March at $1.655 billion.

The balance sheet also revealed that the central bank was successful in the last 15 days in draining some of the lira liquidity from the market. Lira in circulation dropped by LL5 trillion from LL43.5 trillion to LL38.5 trillion.

Inflation continues to trend higher by triple digit percentages, recording a 211.43 percent increase in May.