Barbed wire blocks the area around Banque du Liban. (Credit: Joseph Eid/AFP)

A document recently leaked to the press reveals that the government committee in charge of preparing a plan for the resolution of the large outstanding public debt to be negotiated with the IMF proposes to make the creditors — bank depositors — bear the major cost of such a resolution, instead of the debtors, that is the government and Banque du Liban that heavily borrowed from liberally accommodating commercial banks to finance budgetary deficits.

Although the media reported this week that the government's proposal had already been rejected by the IMF in its current form, we recognize that there is no official confirmation that these actually are the measures that have been presented to the Fund.

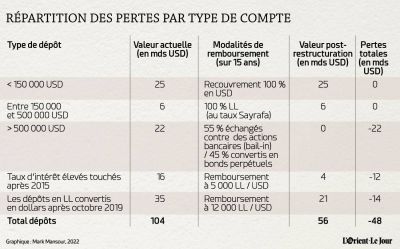

Nonetheless, as reported in the document, the committee intended to recommend eliminating what amounts effectively to roughly 60 percent of total public debt (when calculating at a conversion rate 20,000 Lebanese lira to the US dollar) via different and complex mechanisms which are effectively hair-cuts applied to a very large portion of foreign exchange deposits while converting the remaining deposits into Lebanese pounds at arbitrarily set rates and stretching repayment over a 15-year period.

If such policy action is being envisaged (applying a simple arithmetic formula to eliminate outstanding debt obligations) we, a group of Lebanese professionals with long experience, posit that it is a formula for national economic mismanagement, apart from any legal implications it might carry with it.

Its adverse impact would go way beyond making national and foreign savings in banks — the source of lending and economic activity — bear the brunt of addressing the public debt question.

Such a policy would prompt national and foreign savers to avoid placing their future savings in the Lebanese banking system, even in a reformed system, and thereby cripple national economic recovery by disincentivizing capital inflows despite any international assistance Lebanon may yet be able to negotiate.

Despite any official policy declaration intended to assure national and foreign savers and investors of the sanctity of their foreign exchange holdings — even if a free foreign exchange system is restored, as should be the case — once a policy precedent is set it will always be remembered.

We take this opportunity to remind again that the rapid rise of public debt is due to a continuous rise in fiscal deficits, accommodated by central bank financing, with successive governments ignoring repeated warnings by many professionals and sincere public sector officials of the urgent need to reform the fiscal domain as part of overall economic reform.

Indeed, the public sector includes people of the highest integrity who tried to implement reform. Many of those appointed to various governments were reformers who wished to put in place effective control of corrupt practices. Alas, no basic reforms of fiscal policies and practices were effectively allowed to take place, not to mention other domains of the public sector that have needed reform for a long time now.

The powers that be chose to ignore these warnings for various reasons, including an unwillingness and/or inability to control corrupt fiscal and other practices. Effectively, thirty years after the end of the civil war, the state continues to finance obsolete institutions.

If the leaked document is accurate, the authorities would be well advised to rethink their reported planned action — with its likely highly negative results for the future of the Lebanese economy and its banking system — and focus instead on formulating a rational policy of debt rescheduling as part of a well-prepared plan for national recovery that would restore national and outside confidence in Lebanon and assure its economic and social resurgence.

Signed

Samir Makdisi, Professor of Economics and former Minister of National Economy

George Corm, Professor of Economics and Political Science and former Minister of Finance,

Nicola Tueny, former Minister of State for Fighting Corruption

Boutros Labaki, Professor of Economics and former Vice President of the Council for Development and Reconstruction

Jawad Adra, Managing Partner, Information International

Adel Makaron,

Shukri Ruhayem, writer

Riad Saade, CEO, Centre De Recherches et D'etudes Agricoles Libanais