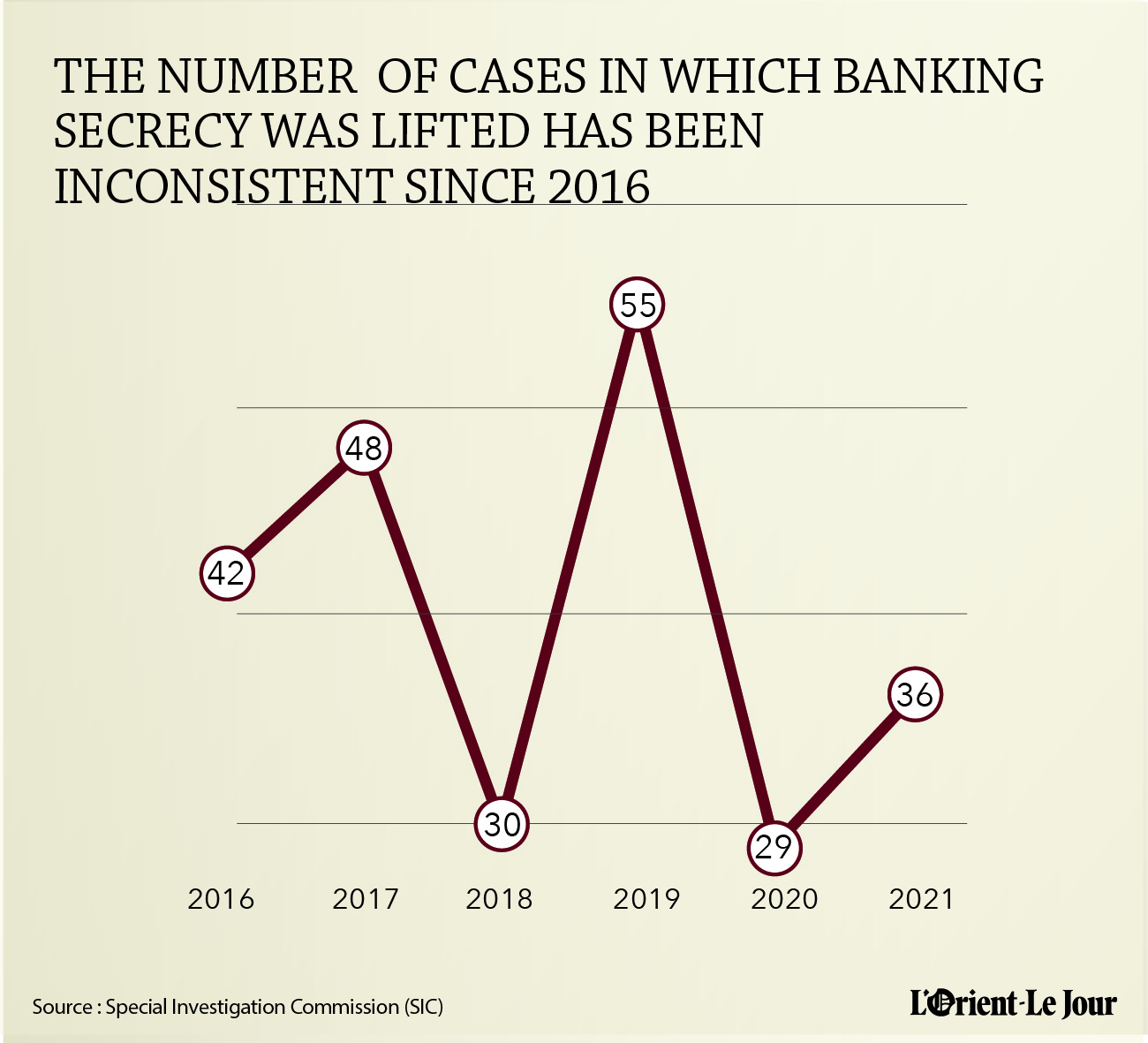

The number of cases in which the Special Investigation Commission (SIC) lifted banking secrecy in 2021 increased, according to the SIC’s annual report, the main results of which were relayed by Bank Byblos’ publication Lebanon This Week. The SIC lifted banking secrecy in 29 cases in 2020, compared with 55 cases in 2019.

The SIC investigated 366 of the 404 suspicious cases it was notified of, and referred 244 cases to the judicial authorities. As for the remainder, 38 cases are still pending and 122 cases do not fall within the scope of Law No. 44 of 2015.

Created by Law No. 318 of 2001 on Fighting Money Laundering, the SIC is an independent authority, although it is chaired by the governor of Banque du Liban, Riad Salameh, which, until October, had exclusive authority to lift banking secrecy from accounts in money laundering-related investigations. In 2015, through Law No. 44, its powers were extended to include combatting the financing of terrorist organizations, tax evasion, corruption, abuse of power and fraud.

On Oct. 18, Parliament passed a law that grants more bodies the authority to lift banking secrecy. However, several NGOs indicated that the newly approved law does not empower BDL, the Banking Control Commission or the National Institute for the Guarantee of Deposits, and that its activation ultimately requires a decision by the SIC, headed by Salameh.

NGOs, including Legal Agenda and Kulluna Irada, denounced the law by claiming that the text only adds more ambiguity and complexity so as to empty the law of its substance.

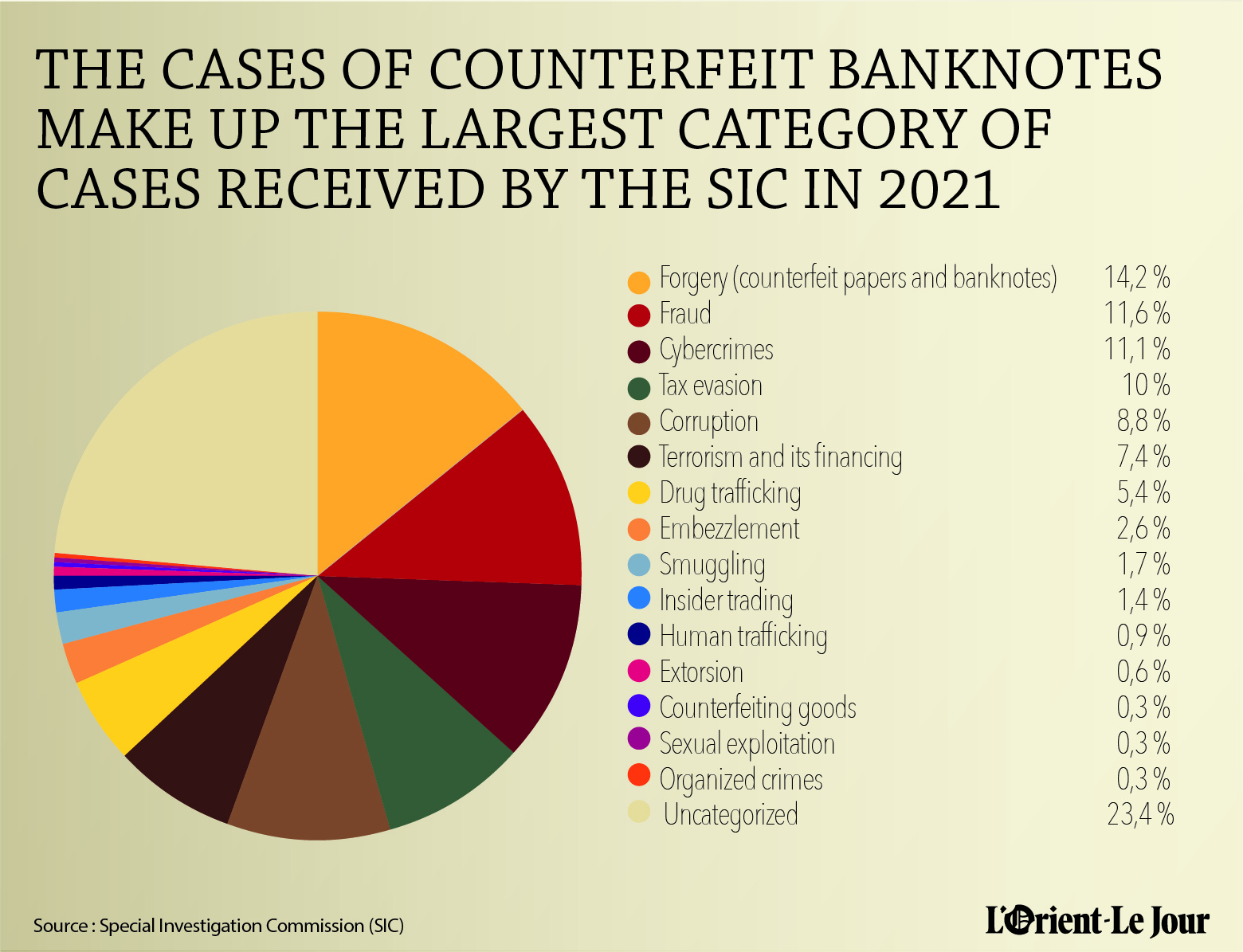

Of the suspicious cases submitted to the SIC in 2021, forgery (counterfeit papers and banknotes) constituted 14.2 percent, followed by fraud (11.6 percent), cybercrime (11.1 percent), tax evasion (10 percent), corruption (8.8 percent), terrorism and its financing (7.4 percent), drug trafficking (5.4 percent), embezzlement (2.6 percent), smuggling (1.7 percent), insider trading (use of confidential information for financial gain, 1.4 percent), human trafficking (0.9 percent), extortion (0.6 percent), counterfeiting of goods, sexual exploitation and organized crime (0.3 percent each). The remaining 23.6 percent did not fit into any category.

In 2021, the SIC received 274 cases from local sources (67.8 percent of the total number of cases), while 130 cases (32.2 percent) came from international sources.

The SIC also received 136 requests for assistance from foreign countries. More than half (59.6 percent) came from Europe, 22 percent from the Middle East and Gulf countries, 8.8 percent from Africa, 3.7 percent from Asia, 2.9 percent from the United Nations and 1.5 percent each from North and South America.

This article was originally published in French in L'Orient-Le Jour. Translation by Joelle El Khoury.