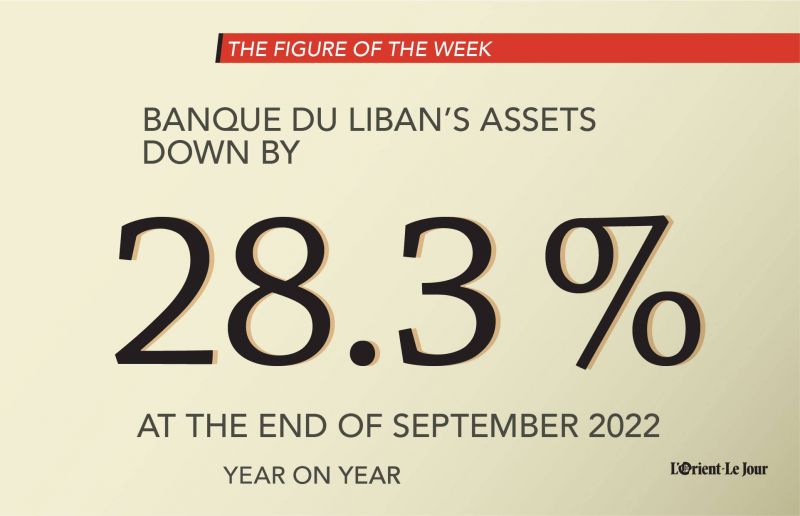

Banque du Liban’s reserves declined by 28.3 percent from September 2021 to September 2022. (Sourced from Blominvest’s Brite)

According to Byblos Bank’s "Lebanon This Week," which sourced Blominvest’s figures, the decline is due to the financing of imports of some basic commodities, which have been subsidized by BDL since October 2019 to curb the loss of purchasing power of the Lebanese, due to the depreciation of the national currency.

Last week, the Lebanese lira was trading at around LL39,000 to the dollar, and hit a record low of LL40,000 on Friday, while the official rate is still pegged at LL1,507.5 to the dollar — a depreciation of more than 96 percent.

Notably, some subsidies have been lifted, such as fuel subsidies, which began to be phased out in June 2021 and accelerated in the summer of 2022.

The BDL officially ended subsidies on fuel on Oct. 7 through Circular No. 643, the last part of which had been removed on Sept. 12.

BDL’s reserves have been decreasing since September 2017 (in $ billion, September of each year). Assets decreased by 71.7% between September 2017 and 2022. (Sourced from Blominvest’s Brite)

BDL’s reserves have been decreasing since September 2017 (in $ billion, September of each year). Assets decreased by 71.7% between September 2017 and 2022. (Sourced from Blominvest’s Brite)

Through this document, Lebanon’s central bank confirmed that wheat, some drugs (against cancer or chronic diseases in particular), raw materials for the pharmaceutical industry, and infant formula would remain subsidized, although at different rations, at LL1,507.5 to the dollar.

Another factor that could explain this decline in foreign exchange reserves is Circular No. 161, which allowed depositors, since December 2021, to obtain fresh dollars from their bank accounts at the rate of Sayrafa, BDL's foreign exchange platform.

This is one of many mechanisms to curb illegal banking restrictions on foreign currency accounts that have been in place since late summer 2019.

Since the onset of the crisis, BDL's reserves have only declined, leading many observers to believe that lifting subsidies were inevitable.

At the end of September 2019, BDL’s reserves stood at $29.3 billion.

Meanwhile, gold reserves reached $15.4 billion at the end of September, a 3.4 percent year-on-year drop, compared to the peak of $18.5 billion in April 2022.

Finally, BDL's balance sheet totaled $178.3 billion in the third quarter of 2022, which is a 12 percent year-on-year increase.