A photomontage designed by Marc Mansour. (Credit: Marc Mansour)

“I continue to live and spend as I did in the days when the exchange rate was LL1,500 to the dollar,” says Elie,* 33, as Lebanon continues to sink into an economic and social crisis set in motion in 2019. An electrical technician by training, Elie owes this privilege to a choice he made at the end of 2018: to retrain in the installation of solar panels and solar energy systems.

At the time, he was 29 years old. He was self-employed, installing surveillance, telecommunications and uninterrupted power supply (UPS) systems for an average monthly income of around LL2.25 million. At the time, that amount equaled about $1,500. This income allowed him to live “decently,” though he couldn’t build up significant savings. At the time he had to pay LL850,000 per month, or about 37.8 percent of his total income, to repay a subsidized housing loan.

Through different projects and discussions with his peers, Elie began to sense that “the country was going to rely more and more on solar power for its energy supply.” He decided to start installing photovoltaic systems. “I had already installed a few systems of this kind in the past, and I had the knowledge and know-how,” he says.

Exploding demand

As the crisis unfolded in 2019, Lebanon, lacking foreign exchange and fuel supplies, was increasingly plunged into darkness. Private generator bills exploded without solving the energy deficit. The switch to residential solar energy has accelerated since then.

This transition has been a boon for Elie, who says demand for solar panels “peaked in 2021.” He lives in Hazmieh but has installed photovoltaic systems “all over Lebanon.”

“I don’t have fixed working hours. Sometimes I start at 8:30 a.m., sometimes at nine and sometimes even at 10. It all depends on the number of projects and where they are located,” he says. Gasoline is a major expense, given all the trips Elie has to make for work. He estimates he pays an average of $300 on fuel per month.

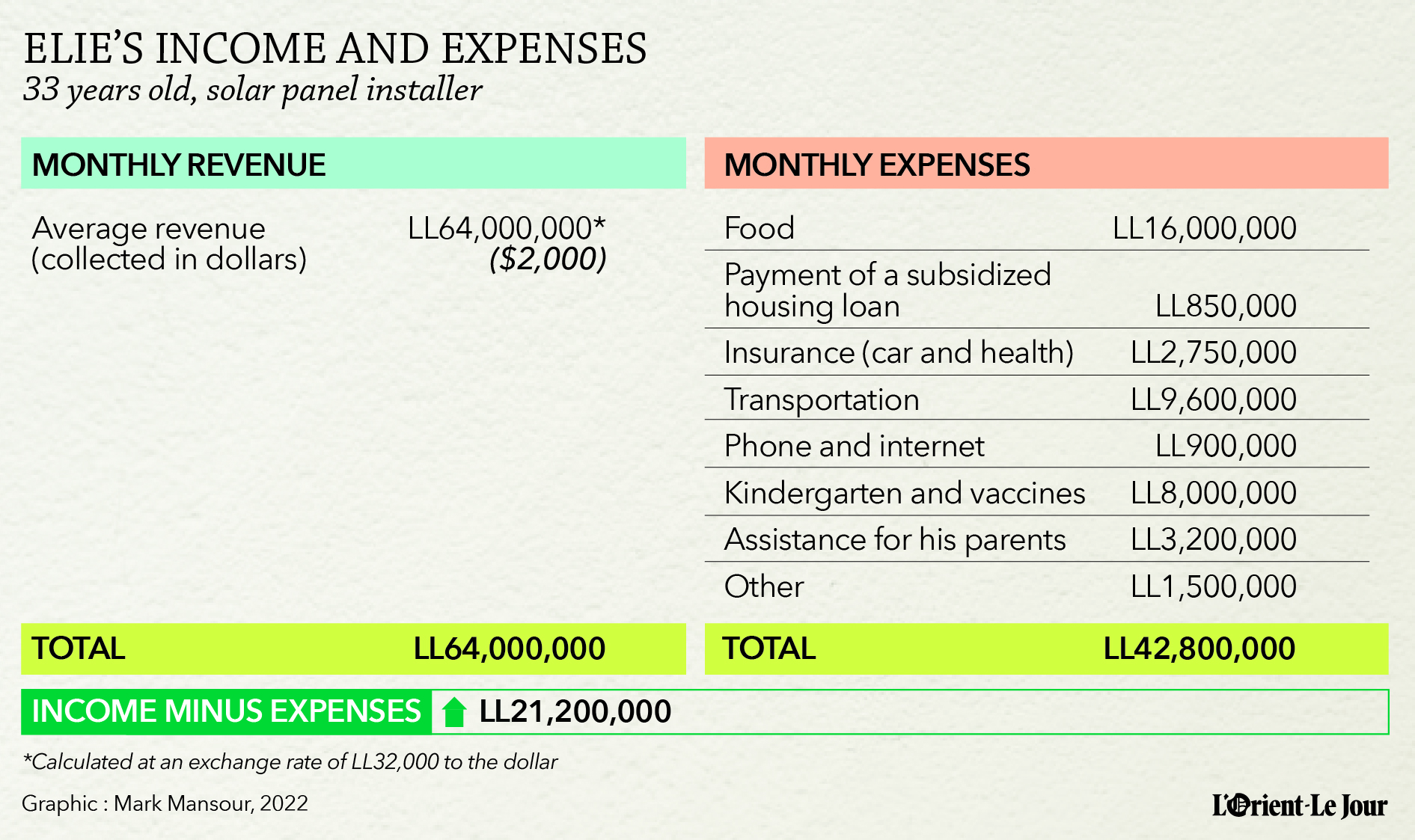

All in all, his work brings in between $1,200 and $3,000 per month depending on the frequency and size of his projects, with an average monthly revenue of $2,000, which he collects entirely in foreign currency. This is the equivalent of LL64 million according to the exchange rate at the time of reporting, which was LL32,000 to the dollar.

With this amount, Elie is able to provide for his family’s needs without relying on his wife’s income. “Even though she works, I try to make sure that she is able to spend her income as she pleases without having to worry about household expenses,” he says.

Expenses

As a father of one, Elie pays for all the expenses of the household, including food (LL16 million), daycare for his son (LL6.4 million) and vaccinations (LL1.6 million), as well as car and health insurance, which amount to LL2.75 million per month. In addition, Elie contributes with his siblings to support his parents to the tune of $100 per month.

This is made possible by the more than 95 percent depreciation of the Lebanese lira, which has reduced Elie’s monthly housing loan payment by the same amount. While this monthly repayment used to be worth more than $565 at the official exchange rate of LL1507.5 to the dollar, it is now worth only $26.5 at the parallel market rate at the time of reporting — LL32,000 to the dollar — and represents just over one percent of his average monthly income.

While he says he is not looking to save money today, Elie still manages to put away more than LL20 million a month. He used to keep the money on hand for emergencies, but in the last few weeks, he has started to think about investing it in his work.

“I'm now looking into the possibility of importing solar panels and residential wind systems that produce electricity without making much noise,” he says, interested in staying self-employed. “But for now, nothing concrete,” concludes Elie.

*L’Orient-Le Jour has published only Elie’s first name in order to protect his identity.

This article was originally published in French on L’Orient-Le Jour.