The Lebanese lira fell to LL23,000 to the dollar on the parallel market on Friday. (Credit: AFP)

BEIRUT — The lira on Friday fell to LL23,000 to the dollar on the parallel market, a first since the formation of Najib Mikati’s government and just shy of its all-time low of LL24,000, a level briefly touched in July after Saad Hariri abandoned his bid to form a new government.

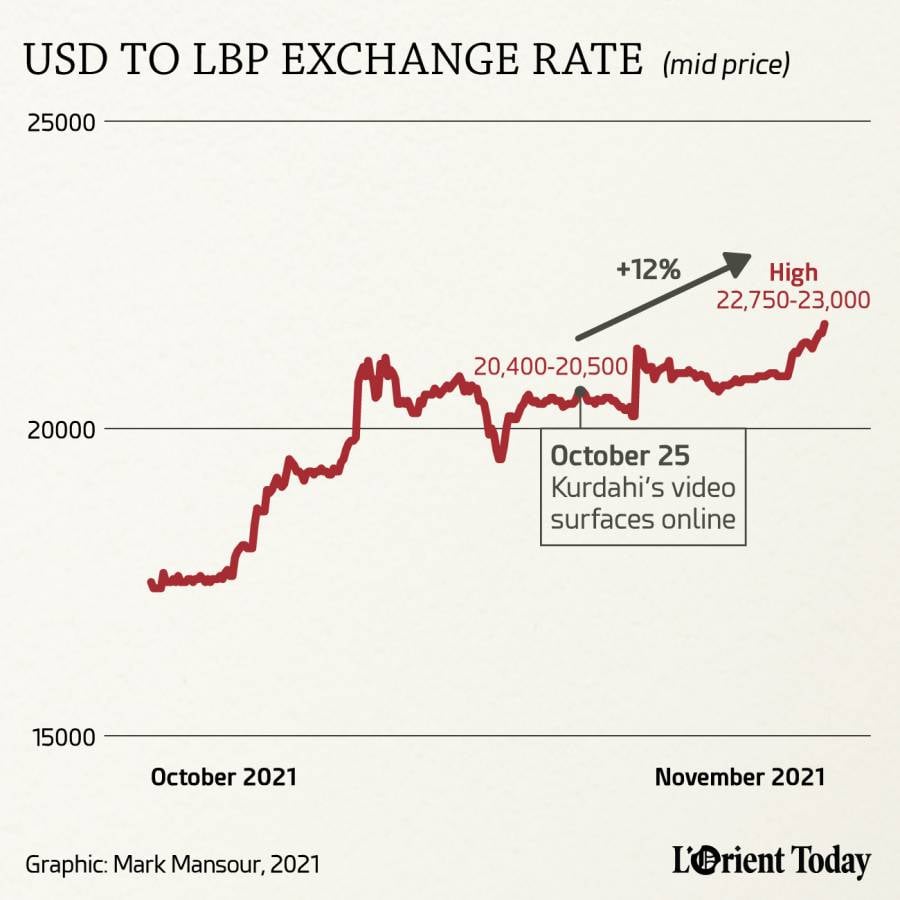

The lira’s recent plunge appears to have been triggered by the diplomatic blowup between Lebanon and the Gulf countries following the broadcast of an interview on Oct. 25 in which Lebanese Information Minister George Kurdahi made provocative comments about Saudi Arabia’s intervention in Yemen.

The decline has so far brought the lira’s losses, since Oct. 25, to 12 percent and to more than 65 percent since the announcement of Mikati’s cabinet, when the currency surged to below LL14,000 to the dollar.

“The recent tensions with the Gulf countries are a new major drag on economic growth,” said a Lebanese banker based in the Gulf who asked not to be named. “They do not only impair Lebanon’s access to much needed foreign currency from exports and remittances, but they undermine the overall confidence in Lebanon’s ability to distance itself from regional conflicts — an unneeded distraction when fighting for the life and death of the country.”

The Lebanese minister’s comments may be the latest provocation, but Saudi Arabia’s mistrust in Lebanon runs deeper and longer.

In a phone Interview with Reuters, Saudi Arabia’s foreign minister, Prince Faisal Bin Farhan, confirmed that the issue is broader than Kurdahi’s comments. He blamed the increasing dominance of Hezbollah on state institutions for the escalating uncertainty.

So far, Kurdahi continues to insist his resignation is out of the question. He says the comments were made in August, a month before his ministerial appointment. He is supported in his decision by the Marada Movement and Hezbollah, both parties not wishing to be seen as giving further concessions. This only manages to expand the rift between government members, already tense as a result of a dispute over Judge Tarek Bitar’s leadership of the investigation into the Aug. 4, 2020, Beirut port explosion and on the back of the Oct. 14 Tayyouneh clashes, which erupted as Hezbollah and Amal Movement supporters gathered to demonstrate against what they describe as Bitar’s “politicization” of the probe.

Amid domestic and regional political uncertainty, the lira is expected to continue its downward spiral. Etienne Harb, a professor of finance at ESSCA Online Campus and a research fellow at ESSCA School of Management explained that “fundamentals are integral to valuations in the financial markets and currencies are no exception; investors’ sentiment is also crucial in limiting volatility and reducing excesses. What we are seeing now is negatively impacting both, which means the currency has not found a bottom yet.”

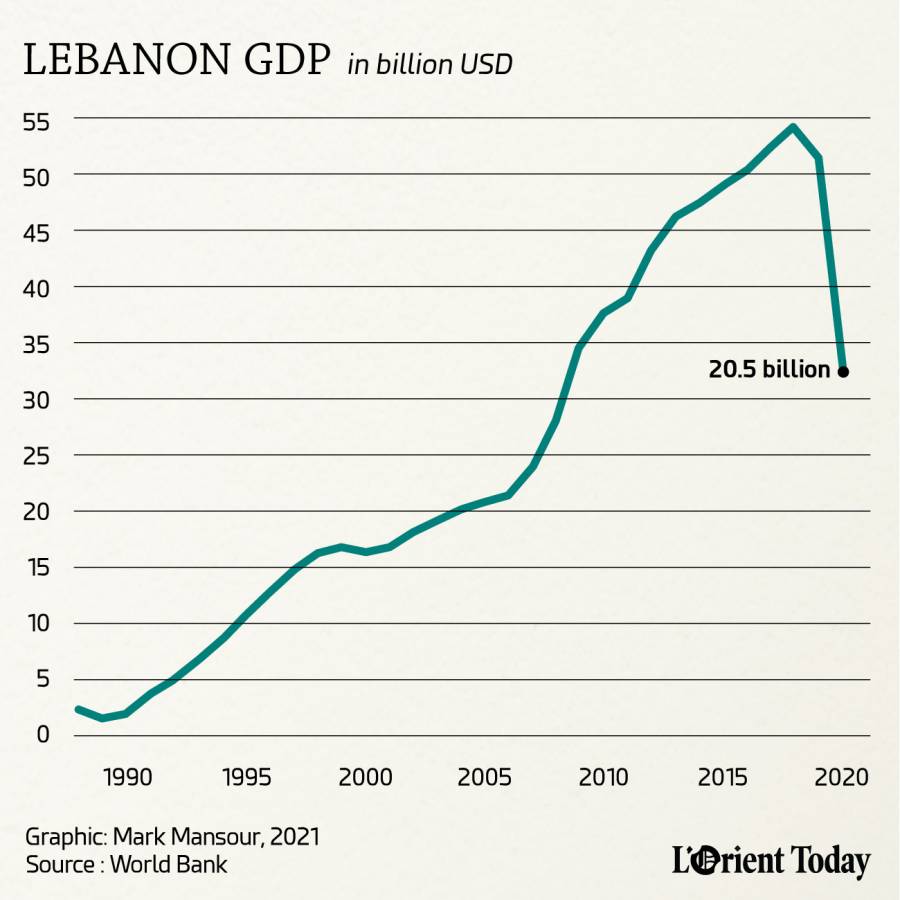

Lebanon’s economy is already reeling from multiple shocks. In fact, the World Bank forecasted in October that Lebanon’s GDP would drop to $20.5 billion in 2021, a 66 percent decline from the $55 billion level seen just two years ago. This number may be revised lower still if there is a blanket embargo on Lebanon by the Gulf states.

“Macroeconomic imbalances continue to negatively impact economic growth and stability; too much uncertainty around the economic data renders all models to value the Lebanese lira unreliable,” Harb added.

Lebanon’s central bank’s actions also appear not to be helping. Its piecemeal decisions regarding import financing are creating more confusion among traders. A 10 percent dollar cash requirement for fuel imports is likely to add more pressure on the lira. Fuel importers are now forced to use the parallel market to buy the necessary dollars, whereas previously they paid 100 percent in Lebanese lira at a LL19,000 exchange rate and it was up to the central bank to provide the dollars.

“The market is sifting through a lot of noise on a daily basis, from one side the strain in the relations with the Gulf is giving free rein to the rumor mill, like the deportation of the Lebanese expatriates, and on the other side the central bank’s last minute decisions about payment requirements, is confusing the market. More volatility and more uncertainty drive these sharp sell offs in the currency,” added the Gulf-based Lebanese banker.