The Banque du Liban headquarters in Beirut. (Credit: João Sousa/L'Orient Today)

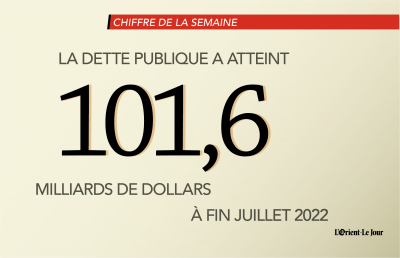

Lebanese public debt amounted to $101.6 billion in late July, according to figures published by the Ministry of Finance and relayed by Lebanon This Week, Byblos Bank’s weekly magazine.

This amount is based on the official pegged official rate of LL1,507.5 to the dollar, although this exchange rate is hardly used anymore in a Lebanon in full economic collapse and where the dollar was trading this week at around LL40,000 on the parallel market.

Taking into consideration the exchange rate set by Banque du Liban’s Sayrafa platform — LL25,700 to the dollar on average in July — the total debt would add up to $43.8 billion.

It should be noted, however, that last week, BDL Governor Riad Salameh announced that by February, only the LL15,000 rate and the Sayrafa rate would be part of the daily life of the Lebanese.

However, he did not explain how he would manage to align the market rate with the Sayrafa rate — the difference between the two is currently almost LL10,000.

This new level of debt consists of a 3.5 percent increase from the $98.2 billion reached at the end of July 2021. The debt has thus grown by $2.6 billion compared to the same period in 2021.

At the end of July 2022, 60.4 percent of the public debt was denominated in lira and 39.6 percent in foreign currency, corresponding to LL92,612 ($61.4 billion at the official rate) and $40.2 billion in foreign currency, respectively, of which $11.5 billion is accumulated arrears.

The ministry did not publish figures related to debt distribution this time.

At the end of July 2021, BDL held 64.2 percent of the lira-denominated public debt, followed by commercial banks with 19.6 percent. Non-bank financial institutions and the public held 16.2 percent. The majority of foreign currency debt was held by Eurobond holders ($38.1 billion), while multilateral institutions held $1.6 billion and foreign governments held $479 million.

According to data previously published, BDL’s and commercial banks’ combined share of public debt totals just over 50 percent — the result of heavy investment in treasury bills and Eurobonds with high yields, which left them extremely vulnerable when the government defaulted on its Eurobond debt in March 2020. Almost three years later, no debt restructuring has taken place.

As soon as rumors of a possible default began to circulate, some of Lebanon's international creditors formed the Ad Hoc Lebanon Bondholder Group to negotiate with Lebanon.

The group did nothing other than remind Lebanon of its obligations, and no real success was achieved.

This article was originally published in French in L'Orient-Le Jour. Translation by Joelle El Khoury.