The Banque du Liban headquarters in Beirut in 2022. (Credit: João Sousa/L'Orient Today/File photo)

BEIRUT — This month, Banque du Liban (BDL) issued Circular No. 166, which went into effect on Feb. 3. It marks the latest in a series of circulars issued since the beginning of the crisis in 2019, meant to “salvage” the losses incurred by depositors and relieve financial pressures.

But what does this new circular actually do?

Circular after circular has been issued — and confusion has risen — as Lebanese citizens can no longer keep track of the options available to them.

Let’s break it down.

All the foreign currency deposited in bank accounts before October 2019 has been subject to informal capital controls, as well as a depreciation of its value. Any US dollars in these accounts became known as “lollars” — that is, the “Lebanese dollars.” They are worth less than an actual dollar on the market. A fresh dollar, on the other hand, refers to real dollars in the economy.

Circulars that are currently active apply to lollar bank accounts. To this date, there are no official numbers indicating the total number of fresh dollar accounts versus the number of lollar accounts in Lebanese banks.

Which circulars are currently active?

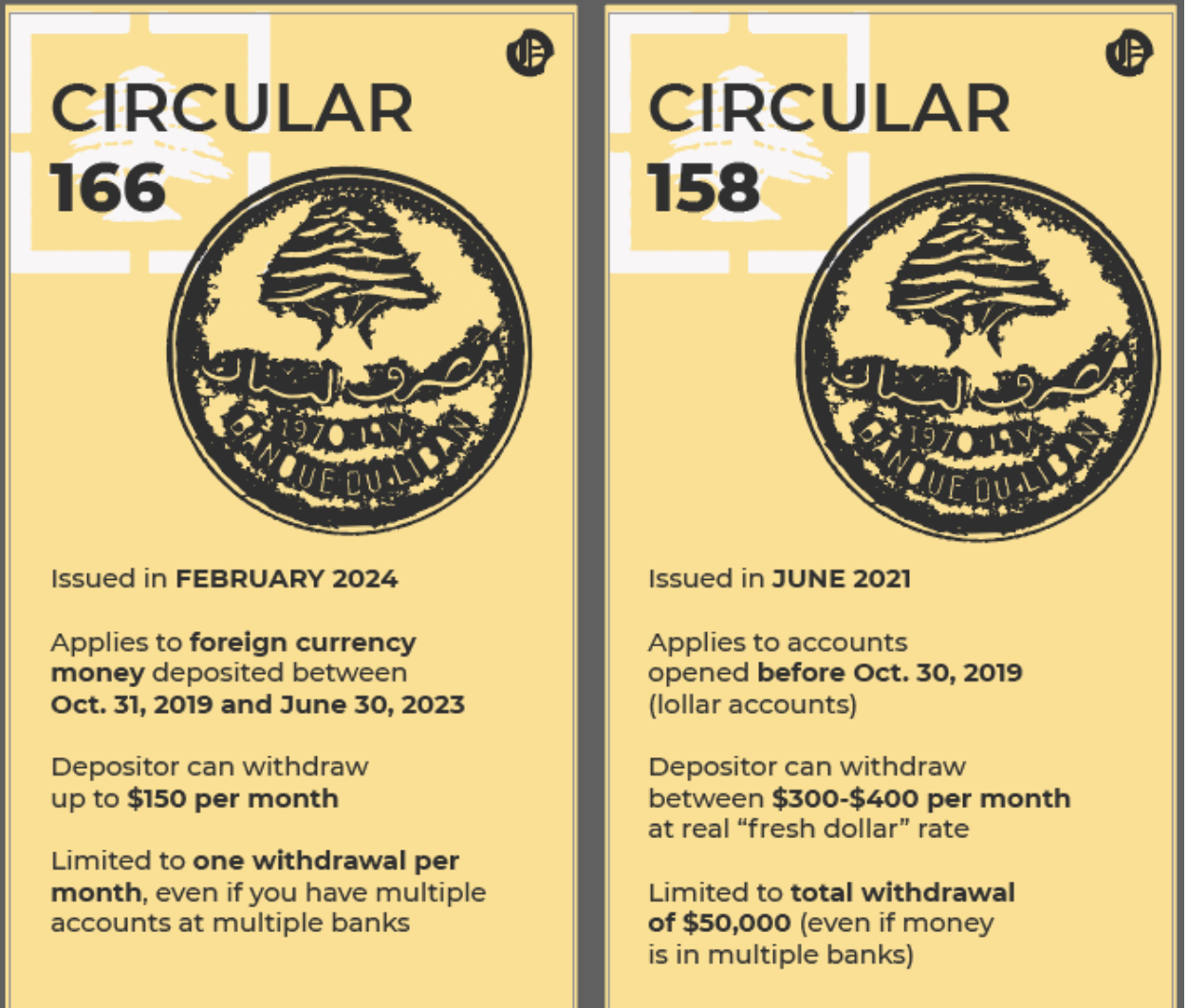

Depositors can currently benefit from two circulars: 166 and 158, on the condition that they sign a waiver allowing BDL to lift banking secrecy off their accounts. This means that BDL can monitor subsequent account activities and determine circular eligibility.

Circular No. 166

The newly published Circular No. 166 allows depositors to withdraw $150 in fresh US dollars from their dollar-denominated bank accounts every month. This circular applies to:

• Accounts opened between Oct. 31, 2019 and June 30, 2023

• Balances accumulated between Oct. 31 2019 and June 20, 2023 on accounts opened before October 2019. (Depositors with accounts opened before October 2019 can be eligible to benefit from Circular No. 166, but only for the funds accumulated, present or added after Oct. 2019)

Circular No. 166 replaces Circular No. 151, first adopted in April 2020, which allowed only small withdrawals in Lebanese lira from dollar-denominated accounts at an exchange rate well below that on the market. Circular No. 151 expired on Dec. 31, 2023.

Holders of multiple bank accounts can benefit from the new circular for one of their bank accounts only. In other words, whether clients have 10 accounts or just one, in one bank or many, they will only be able to receive one payment of $150 every month, up to a limit of $4,350 — that is, 29 payments of $150.

According to Blominvest’s website, Circular No. 166 is set to exclude depositors who:

• Are already benefiting from Circular No. 158 (keep scrolling down to understand what this one does)

• Have accounts that witnessed check movements after Oct. 31, 2019

• Made conversions from Lebanese lira to US dollars through their accounts in the amount of $300,000 or more, at the exception of conversions related to pension fund deposits

• Benefitted from the Sayrafa platform for amounts upwards of $75,000.

Circular No. 158

Circular No. 158, first adopted in June 2021, allows withdrawals of $300 to $400 in “fresh” dollars from foreign currency bank accounts opened before Oct. 30, 2019 (lollar accounts).

In other words, what used to be considered a “lollar” can be withdrawn at its real “fresh dollar” value, at up to $300-400 per month.

Depositors who signed up for the circular before June 30, 2023 can benefit from $400 every month. Meanwhile, those who chose to benefit from the circular after July 1, 2023 can access only $300 per month.

Depositors will thus be able to withdraw between $3,600 and $4,800 (fresh dollars), from their accounts on a yearly basis.

Circular No. 158 allows withdrawal up to a combined total of $50,000. If depositors had $20,000 in Bank 1 and $30,000 in Bank 2, they can benefit from a monthly withdrawal from Bank 1 until they receive the full $20,000, before moving on to Bank 2 where they can receive the remaining $30,000 also in the form of monthly payments of $300 to $400. The money can be disbursed simultaneously from two different banks so long it does not exceed $3,600 or $4,800 per year — depending on if the depositor is allowed $300 or $400 monthly withdrawals.

What are the procedures to benefit from the circulars?

To benefit from Circular No. 158 and No. 166, depositors must first apply and wait for a BDL unique number to be generated.

Once (and if) approved, the funds will be transferred to a “sub-account” with a fresh dollar account directly linked to it. Payments will be made to this account on a monthly basis, and depositors will receive a card linked to the fresh account, which they can use to withdraw funds from an ATM or over the counter.

In certain cases, holders of debit cards can use funds abroad when traveling, the bank source explained to L’Orient Today.

Credit: Jaimee Lee Haddad

Credit: Jaimee Lee Haddad