Beirut skyline seen from the seaside arena area. Credit: PHB

-The European Bank for Reconstruction and Development (EBRD), a financial institution partly funded by the European Union (EU), launched a new €12.5 million (equivalent to $13.5 million) program to support Lebanon’s private sector.

The aid is intended to help small and medium-sized enterprises (SMEs) adopt resource-efficient practices and aims to promote circular economy mechanisms, focusing on sustainable production and reducing resource consumption and waste.

In a press release after the announcement, the EBRD stated that the funds will be disbursed to industrial SMEs, especially in the agri-food sector, over nine years to help them enhance sustainable operations and decrease carbon emissions. The funds will be used to “build capacity,” provide “tailored advice” and offer “grants for [adopting specific] technologies and solutions.”

-The insurance sector has recorded losses of around $950 million between 2019 and 2023 due to Lebanon’s economic crisis, according to L’Orient Today’s calculations based on figures from the Association of Insurance Companies in Lebanon (ACAL).

ACAL told L'Orient Today that the sector suffered a 25 percent drop in non-life insurance (medical, motor, fire and marine) premium package sales between the end of 2019 and 2023. This represents a loss of $600 million in the non-life insurance market over this period, not to mention the $1.2 billion in assets that remain trapped in banks (i.e. 64 percent of the sector’s overall invested assets) to which insurance companies have no immediate access.

Meanwhile, as far as life insurance contracts are concerned, the latest ACAL figures show that the number of premiums sold fell from 350,000 at the end of September 2019 to 197,000 at the end of May 2022, a drop of 43.7 percent, resulting in losses of around $350 million.

-After being shielded against the uncertainties linked to Israel’s war on Gaza and its repercussions in Lebanon, the Purchasing Managers' Index (PMI) for Lebanon is now taking a hit. Published by Blominvest, it reached 47.9 points in May, its lowest level in 16 months.

This month’s results showed that the Lebanese private sector is less and less optimistic ahead of the summer season, which generally starts in June, as the looming threat of war and subsequent security concerns could deter tourists and expats from the diaspora from coming in large numbers to spend their summer vacation in Lebanon.

-Tourism revenues estimated by the Banque du Liban reached 5.41 billion dollars in 2023, representing a slight increase (+1.7 percent) on the 5.32 billion dollars achieved in 2022. These represent inflows, i.e. money spent in Lebanon by visitors, who are essentially diaspora and accounted for 30.2 percent of Lebanon’s Gross Domestic Product (GDP) in 2023, compared with 25.3 percent in 2022.

This result has been adversely affected by the war that broke out in Gaza in October 2023 and has since spilled over into south Lebanon, with some airlines halting services to Lebanon and others reducing the number of flights to Beirut.

-After suspending subsidized housing loans for more than five years, the Banque de l'Habitat resumed its activities on June 3 and is now accepting applications again from Lebanese people who wish to buy property in the country.

Unlike the old system, where customers applied in person at a bank branch, applications are now submitted online, through a platform set up by the bank. Antoine Habib, CEO of Banque de l’Habitat, said that in just 3 days, more than 18,000 people have visited their website to find out how to apply. Nearly 900 have started the process, and almost half have already submitted their applications.

-After a 15-month absence from the Lebanese market, Global Blue, the Swiss company specialized in VAT refunds on purchases made by visiting tourists, has announced that it is resuming its activities in Lebanon, after reaching an agreement with retailers and the Finance Ministry.

“Tax refund operations will resume from the beginning of June and will be carried out in dollars,” Joe Yacoub, CEO of Global Blue's Lebanese subsidiary, told L'Orient-Le Jour, announcing the news at a press conference at the Beirut Merchants Association (ACB) headquarters.

Established in Lebanon in 2002, the company had suspended its duty-free operations in Lebanon since 27 February 2023.

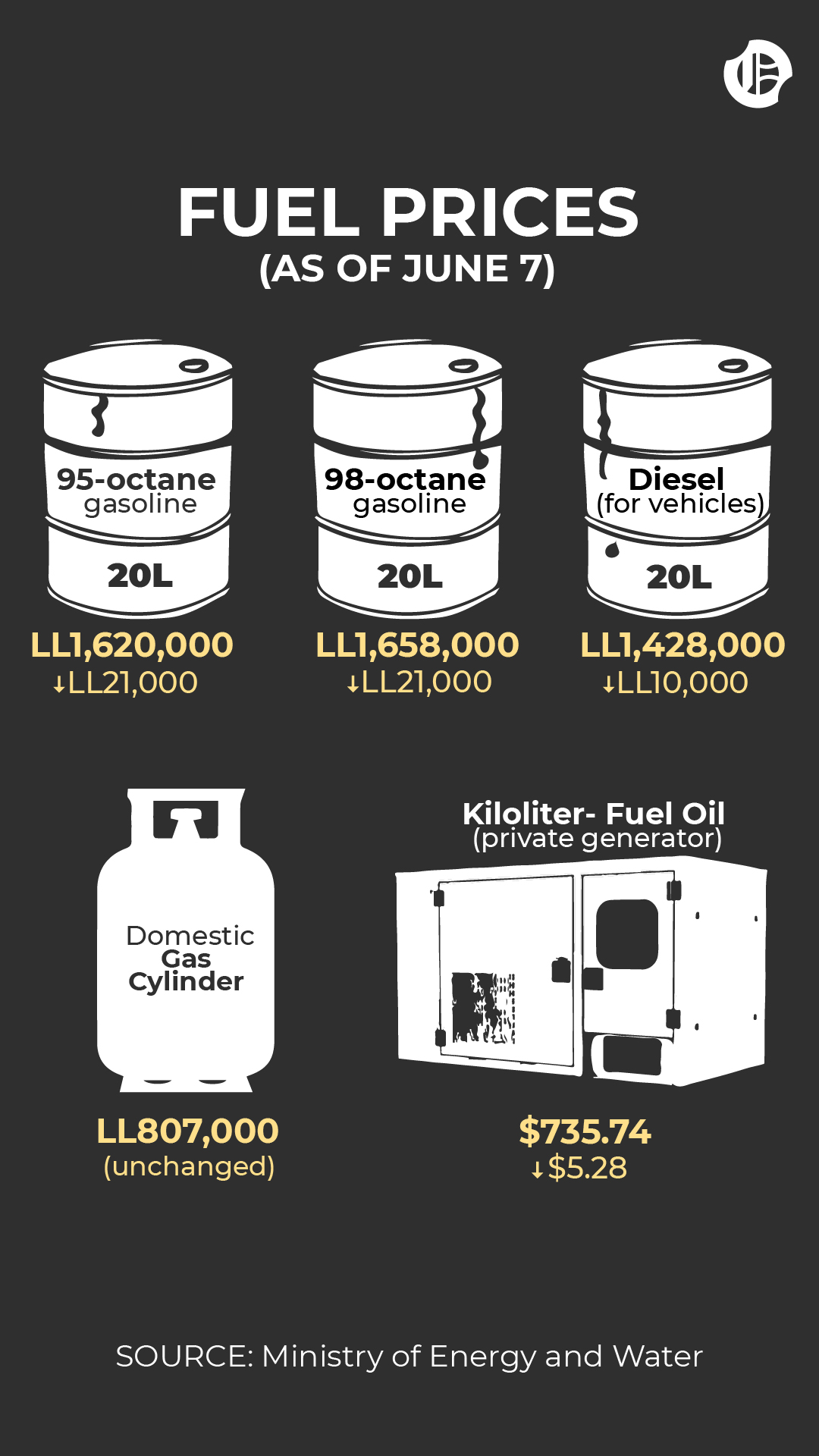

-All fuel prices decreased in Lebanon on Friday. Here are the new rates as shared by the Energy and Water Ministry:

Analysis of the week

A newly leaked official document revealed substantial foreign transfers made during the initial months of illegal restrictions on foreign currency deposits imposed by Lebanese banks, more than four years since Lebanon’s financial crisis began. Read Mounir Younes’ piece: