Illustrative photo. (Credit: Bigstock)

“It’s chaos; nobody knows what to do,” Nadim Daher, an expert accountant, and member of the board of the Lebanese Association for Taxpayers' Rights (ALDIC), told L’Orient-Le Jour in recent weeks.

On April 2, the Finance Ministry said that, from this month onwards, income taxes will be calculated using the LL89,500 exchange rate and the new tax brackets adopted in February in the 2024 budget.

Then on April 24, the National Social Security Fund (NSSF), which has also begun to adopt this new rate, has capped the contributions to be paid for health insurance at a salary of LL90 million.

Things started to take shape, after weeks of confusion over the applicable exchange rate when calculating income tax or the contributions to the NSSF.

The LL90 million NSSF ceiling, which is equivalent to five times the minimum wage according to a decree published in the Official Gazette in February, was raised after the minimum wage was doubled to LL18 million as of April. This is despite the caretaker cabinet having approved a ceiling of LL50 million in April — though that decision was not published in the Official Gazette.

While taxes and contributions that the employees and employers pay have almost returned to pre-crisis levels, Daher said, “These two parties will start to heavily feel the impact, as they paid in recent years only a small proportion of what they used to pay before the crisis,” he added.

What has changed

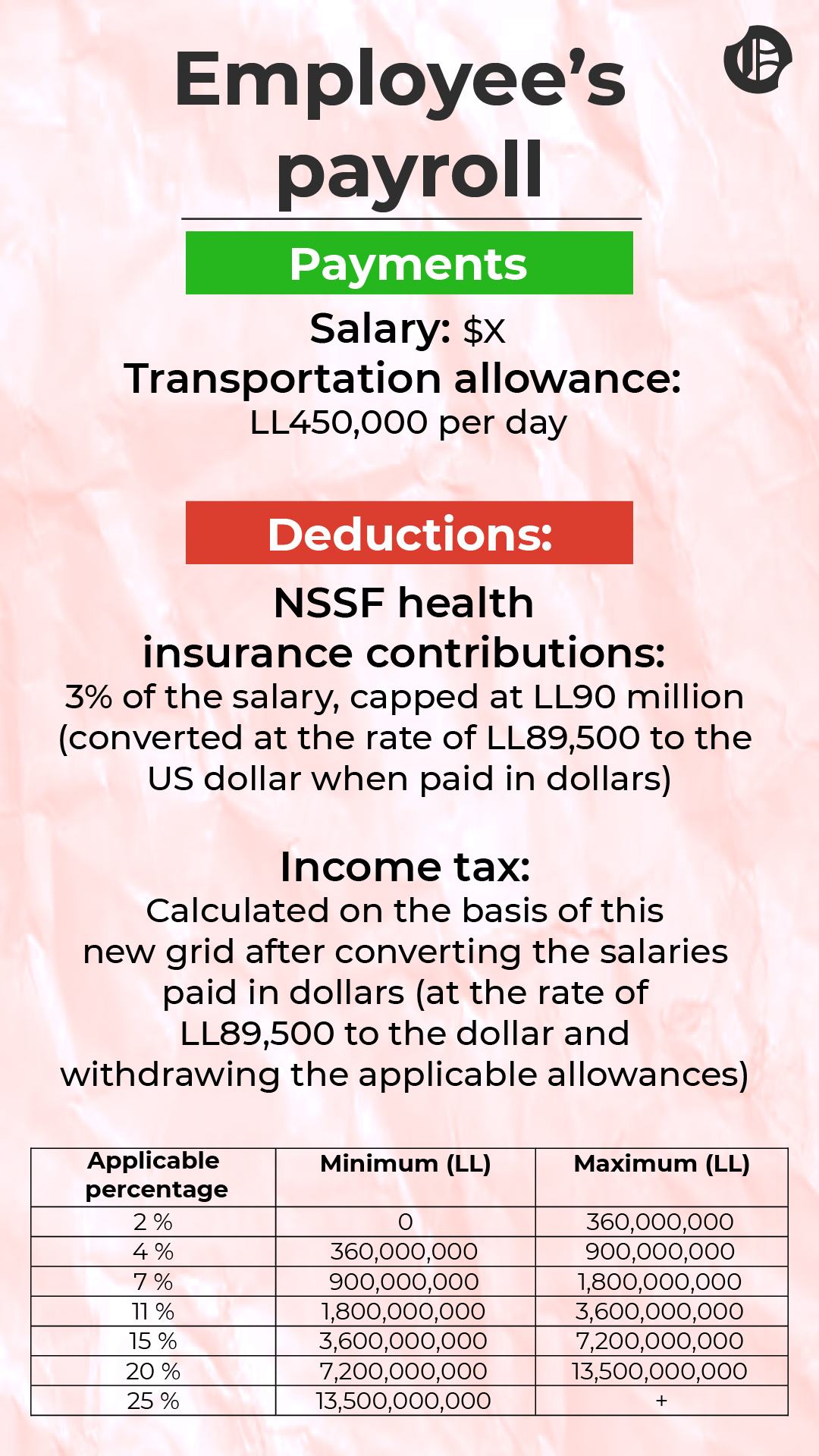

Employees whose situation is in order — whose salaries are declared to the Finance Ministry and who are registered with the NSSF — are affected in terms of the sums they receive (the daily transport allowance) and those deducted from them at source (income tax and contributions going to the NSSF’s health insurance). Here’s what’s new for them:

- The daily transport allowance has been increased from LL250,000 to LL450,000 since mid-February, i.e. from $2.80 to $5.

- Income tax for people who receive their salary in dollars is now calculated at a rate of LL89,500 as of April 1, compared with LL15,000 previously. The brackets and allowances based on which taxes are calculated have been multiplied by 20. On the other hand, those who are paid in Lebanese lira could find themselves paying fewer taxes if their salaries have not been adjusted and are therefore in lower taxable salary brackets.

- Contributions to the NSSF’s health insurance branch, equivalent to three percent of a person’s salary, are also calculated based this new rate of LL89,500, and are paid up to a salary ceiling of LL90 million as of April (the equivalent to five times the minimum wage, raised to LL18 million as of April). All sums over this LL90 million threshold are therefore not subjected to taxes — as a reminder, this ceiling was LL18 million in February and LL45 million in March.

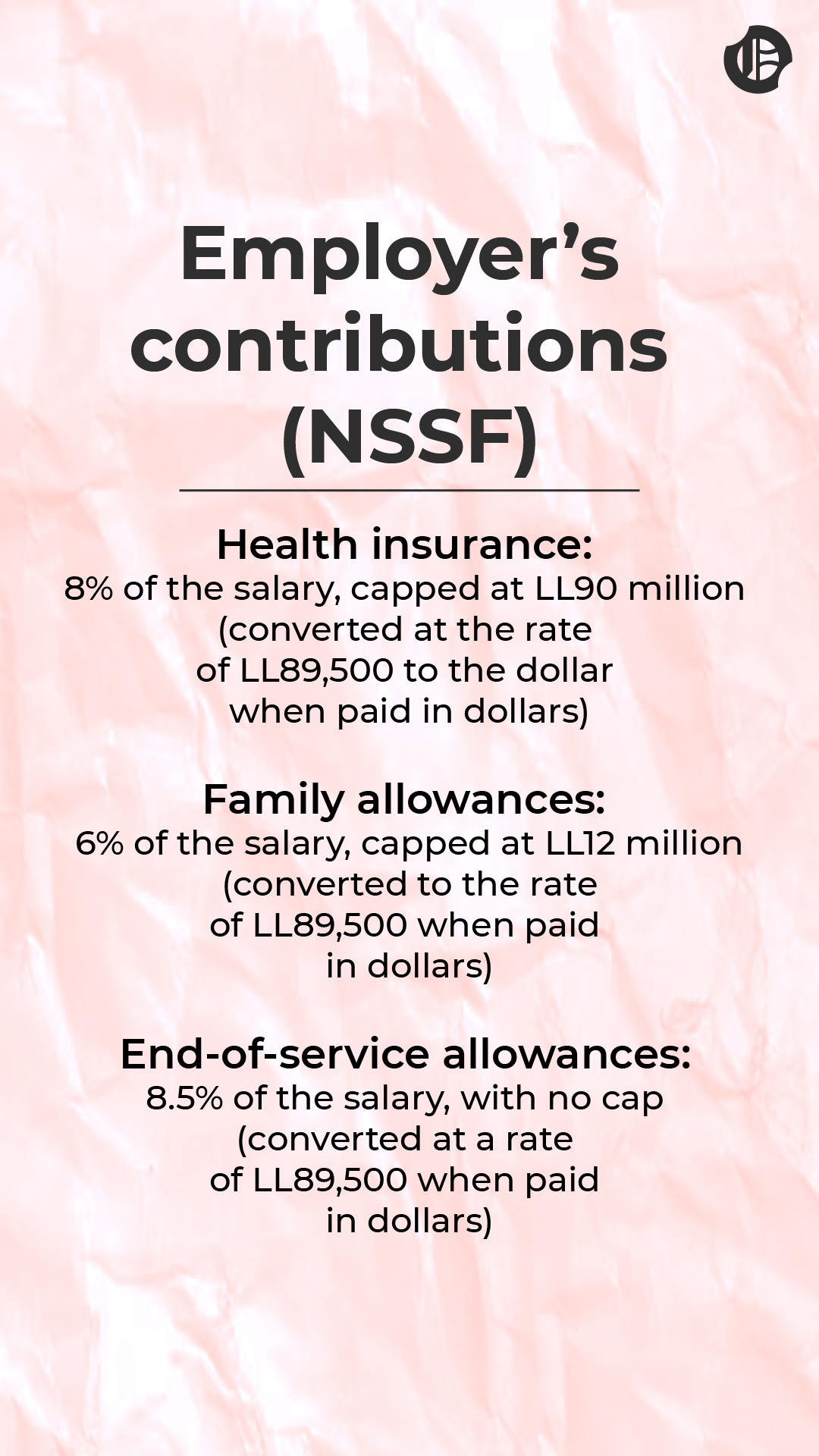

Here are some of the main changes for employers:

- The daily transport allowance increased from LL250,000 to LL450,000 in mid-February.

-Contributions to the NSSF health insurance branch, which is equivalent to eight percent of the salary, now take account of this new rate of LL 89,500 and raise the ceiling to LL90 million as of April, compared with LL18 million until February and LL45 million in March.

- Contributions to the NSSF family allowance branch, equivalent to six percent of the employee’s salary, are still calculated based on the LL12 million limit.

- Contributions to the NSSF’s end-of-service benefits branch, equivalent to 8.5 percent of the employee’s salary, are now calculated at a rate of LL89,500, with no ceiling.

What are the real implications?

In concrete terms, as far as employees are concerned, the relative share of income tax has returned to its pre-crisis level, with brackets and allowances multiplied by 60 —a ratio that is almost equal to that of the depreciation of the Lebanese lira, which went from LL1,507.5 LL to LL89,500 in four years. Contributions to NSSF have also returned to pre-crisis levels for salaries below LL90 million ($1,005). The fact that the ceiling up to which contributions are increased is still below its 2019 level works in favor of those paid above this threshold, namely above LL90 million.

When it comes to the employers, contributions to the NSSF for health insurance and end-of-service indemnities have returned to their pre-crisis levels, while those paid for family allowances have remained lower for the time being.

So what will these changes actually mean for people? We look at three hypothetical employees, each of whom is single:

An employee who is paid the minimum wage:

With this month’s latest news, the minimum wage in Lebanon stands at LL18 million (currently $201), compared with LL9 million between April 2023 and March 2024 (around $100.50 at the time) and LL675,000 before the crisis ($450 at the time).

For the employee: The total deductions equal $6 per month or three percent of their salary, compared with six percent in January for a lower nominal salary. Before the crisis, this ratio was five percent, with the employee paying $22.50 for a salary equivalent to $450.

How it was calculated: Since the employee’s annual salary of LL216 million is below the LL450 million allowance applicable to single people, this employee pays no income tax. At the same time, as the monthly salary is below the ceiling of LL90 million ($1,005), this employee will pay the NSSF three percent in health contributions, i.e. LL540,000 per month, or $6.

For the employer: Following the latest changes introduced by the NSSF, the contributions paid on the minimum wage amount to the equivalent of $41.20, compared with $22.60 at the start of the year and $101.25 before the crisis.

How this was calculated: Health insurance (8 percent of the salary, capped at LL90 million, namely LL1.44 million per month, or $16.1) + family allowances (6 percent of the salary, capped at LL12 million, namely LL720,000 per month, or $8) + end-of-service benefits (8.5 percent of the salary, namely LL1.53 million per month, or $17.1).

An employee who earns $1,000 per month:

For the employee: The total salary deductions now amount, according to our calculations, to $46.50 (or 4.65 percent of his salary) per month following the changes introduced in the 2024 budget and by the NSSF, compared with $15.6 (1.56 percent) and $46.5 (4.65 percent) respectively in January 2024 and 2019.

How it was calculated: Given that the employee’s annual salary of LL1.074 billion falls into the first two brackets (up to LL360 million; and from LL360 million to LL900 million), tax rates of two and four percent apply respectively to the amounts included in these brackets, after deducing the LL 450 million applicable to single people. In this case, the employee must pay LL1.48 million per month, or $16.5 per month.

Furthermore, since the monthly salary (after conversion) falls within the LL90 million ceiling, this employee will pay three percent on his entire salary for the NSSF health branch, i.e. LL2.685 million per month, or $30.

For the employer: In this example, the employer’s contributions now amount to $173, compared with $38.35 just before the new tax regulations came into force. Before the crisis, this figure was $225, due to the NSSF’s higher ceiling for family allowances: LL2.5 million in 2019, or the equivalent to $1,667, compared with LL12 million now, or the equivalent to $134. Apart from this, employers pay the same contributions for health insurance and end-of-service indemnities as they did before the crisis.

How this was calculated: Health insurance: (LL7.16 million per month, or $80) + family allowances (LL720,000 per month, or $8) + end-of-service benefits (LL 7.61 million per month, or $85).

An employee who earns $2,500 per month

For the employee: In this scenario, an employee now earns the equivalent of LL 223.75 million in the eyes of the state and NSSF, and consequently pays $160.2 per month (or 6.41 percent of his salary), compared with $63.2 in January 2024 (2.53 percent) and $181 per month (7.24 percent) in 2019.

How it was calculated: Given that the annual salary of LL2,685 million falls into the first four brackets (0 to LL360 million; LL360 million to LL900 million; LL900 million to LL1,800 million; and LL1,800 million to LL3,600 million), tax rates of 2, 4, 7 and 11 percent apply respectively to each of these brackets, after deducing the LL450 million applicable to single people. In this case, the employee must pay around LL11.64 million per month, or $130.

At the same time, and given that the monthly salary exceeds the ceiling of LL90 million, this employee will pay the NSSF three percent of the salary in contributions to the health branch up to this ceiling, i.e. LL2.7 million per month, or almost $30.2.

For the employer: Following the latest changes introduced by the NSSF, contributions hit $300.9 per month, compared with $59.7 before they came into force. Before the crisis, this figure was $392.5, due to the NSSF’s higher ceiling on family allowances. Apart from this, employers pay the same contributions for health insurance and end-of-service indemnities as they did before the crisis.

How it was calculated: Health insurance: (LL7.2 million per month, or $80.4) + family allowances (LL720,000 per month, or $8) + end-of-service benefits (LL19,018,750 per month, or $212.5).