Street art in Beirut depicting former Banque du Liban Governor Riad Salemeh. Nov. 19, 2022. (Credit: João Sousa/L'Orient Today)

Lebanese depositors residing in the United States launched a class action on April 16 in the District Court of New Jersey (the equivalent of a trial court in this East Coast state), targeting the BDL, its former governor Riad Salameh, several banking chains in Lebanon and the auditors of the banks and the BDL.

The complaint also targets the auditing firms employed by the banks at some point, namely Deloitte, Ernst & Young (EY) and BDO International, through some of their subsidiaries. The complaint also names a handful of banks that are part of the Association of Banks in Lebanon (Bank of Beirut, BLF, BLOM Bank, Byblos Bank, Fransabank and SGBL) and includes all other Lebanese commercial banks as potential third-party "co-conspirators."

Two Lebanese businessmen — Ali H. Khalil and Husayn Shahrur — are on Forbes Middle East's list of Top 30 Asset Managers of 2024, published last week.

Ranked at number 26, Shahrur is the CEO of ABK Capital, the investment arm of Al Ahli Bank of Kuwait, where he is also based. ABK Capital, which provides asset management solutions and investment advisory services in the region, had $2.3 billion of assets under management in 2023, according to Forbes.

Ranked at number 22, Khalil is the Chief Executive Officer (CEO) of Kuwait Financial Centre “Markaz,” an asset management and investment banking group headquartered in Kuwait, where he is currently based.

According to Forbes’ website, Markaz’s reported total assets under management amounted to $3.94 billion in 2023, and recorded revenues of $85.5 million the same year.

The Consumer Price Index (CPI) recorded an annual growth rate of 70.36 percent and a monthly change of 1.72 percent, according to the latest update from the Central Administration of Statistics (CAS) published on Monday.

After almost five years of crisis, Lebanon’s CPI (which measures inflation and is calculated in Lebanese lira) has slowed since the start of the year and is now showing a double-digit annual growth rate (instead of triple digits), the first time this has happened since June 2020.

Banque du Liban (BDL) announced on Thursday that it would reintroduce the use of bank cards. The central bank is reportedly coordinating with the Finance Ministry and international payment networks to "reduce the use of cash in the Lebanese market," prevent money laundering and hald the “financing of terrorism.”

Encouraging card payments would enable BDL to tighten its grip on the cash in circulation, with the goal of stabilizing the Lebanese lira exchange rate, which has been stuck at around LL89,500 to the dollar since 2023.

To boost card payments, the BDL announced that it had asked Visa and Mastercard to reduce fees for local use — "in particular, cards issued outside Lebanon and used on the Lebanese market.” BDL also asked banks and financial institutions to provide access to card services "at the lowest possible cost" and asked merchants not to impose additional charges for payments by card, a common practice since the start of the crisis.

The central bank also announced that it was working with the Ministry of Finance to establish a system by which taxes can be paid by card. Payment terminals would be installed in each of the ministry's branches.

General Security has announced new fees for residence permits for foreign nationals, in line with the LL89,500 Lebanese lira exchange rate. Holders of some types of work permit will see the cost of their visa multiplied by 45. Check the new fee changes here.

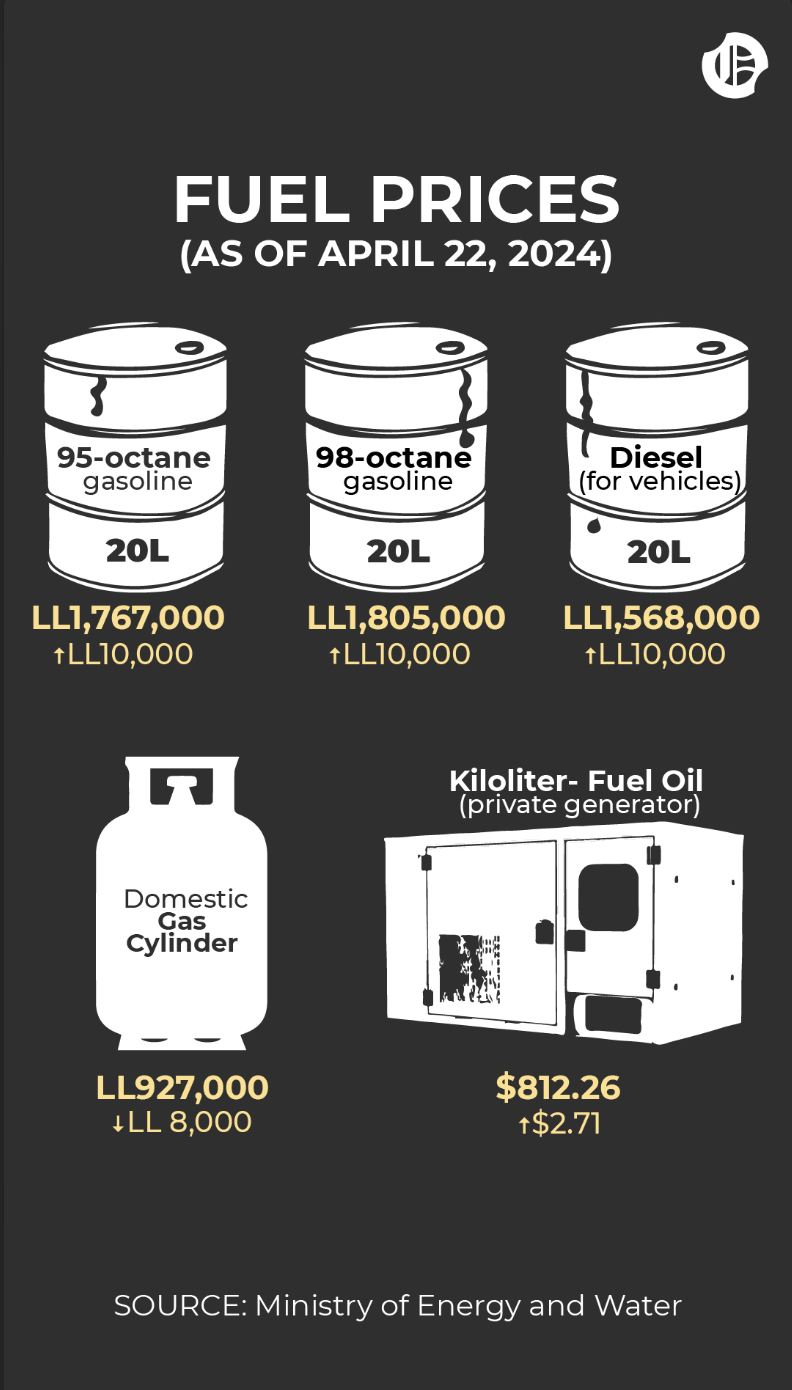

The prices for all forms of fuel, except for gas cylinders, rose in the latest update from the Energy Ministry.

Here are the new prices: