BDL. (Credit: Joao Sousa)

Nearly $1.8 million was spent on art. Approximately $1.1 million went into office furniture (described as “excessive by nature” in Alvarez & Marsal’s report), and $7.6 million was disbursed on sponsoring events.

Made between 2015 and 2020, these Banque du Liban (BDL) expenses were deemed “inappropriate” and unnecessary in the preliminary report of Alvarez & Marsal (A&M), the firm tasked with carrying out a forensic audit of the bank's accounts.

Leaked on Aug.7, 2023, the firm’s report notably accused the central bank of having resorted to accounting tricks to falsify its balance sheets and camouflage the real losses incurred during this period.

BDL has overvalued its assets, its own funds, and its profits and has undervalued certain losses. This has allowed it to “inflate” its balance sheet over the years, “both in assets and liabilities,” and to close the year “with amounts chosen by the governor without there being any explanation,” said the auditors.

Beyond the expensive financial engineering and dubious transactions, A&M’s report also highlights expenses that are surprising, to say the least. These expenses were incurred while BDL accumulated real losses of several billion dollars.

Given the gravity of the crisis, a reduction in this expenditure would not have changed much of the current situation, but scrutinizing it makes it possible to glimpse the state of denial in which the institution lived, as Lebanon drifted toward the financial abyss.

Aid, donations, sponsorships

To start, BDL’s most significant expenditures are those listed in the “aid and donations” category, which amount to nearly LL30.8 billion between 2015 and 2020, i.e. the equivalent of $20.4 million at the exchange rate at the time. If such allocations are not out of the ordinary or illegal for a central bank, what is actually out of the ordinary, the authors of the report believe, is that BDL disbursed these funds when they “could be considered inappropriate if BDL’s financial situation had been examined more closely.”

The report only mentions the five most-important recipients who alone monopolize almost a fifth of this entire sum.

- Beirut Marathon Association: more than LL2.1 billion ($1.4 million) in sponsorship and registration of its employees for the event.

- The Beirut Chamber of Commerce, Industry, and Agriculture: nearly LL1.4 billion ($925,000) to support the opening of the HEC Paris university campus in Beirut ($750,000) and to help set up a food safety training center ($175,000).

- The al-Iktissad wal aamal media group: more than LL1.1 billion (nearly $740,000) for the organization of several conferences.

- First Protocol SARL: LL942.2 million (or $625,000) for the organization of several conferences as well.

- Bahia Baha'eddine Hariri: LL829.1 million (or $550,000) for the organization of a conference.

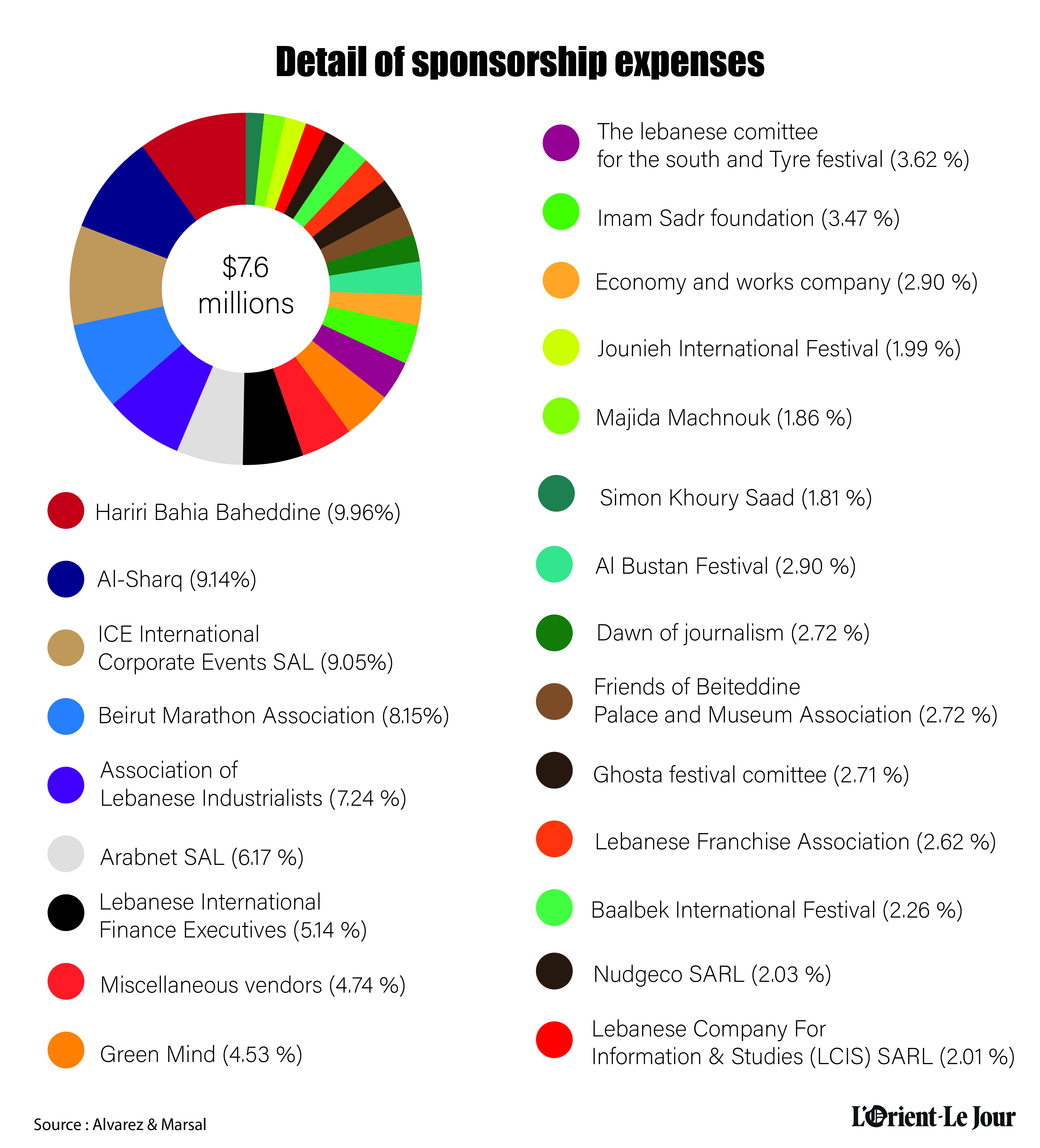

These “aid and donations” items also included expenses related exclusively to sponsoring events, conferences, and charities, hovering around LL11.5 billion ($7.6 million). Although nothing prevents central banks from making this kind of disbursement, the report’s authors note that “there are no policies governing this type of expenditure, as it is entirely at the discretion of the central council,” and that they are “inappropriate,” they reiterate, given its financial situation.

In this context, BDL sponsored several music and cultural festivals between 2015 and 2020 for a total budget of more than LL1.3 billion (nearly $900,000). Sour, Al-Bustan, Beiteddine, Ghosta, Baalbeck, and Jounieh festivals benefited. It also sponsored events organized by economic lobby groups (the Association of Lebanese Industrialists, LIFE, the Lebanese Franchise Organization) to the tune of just under LL1.3 billion (nearly $845,000) and by media outlets — ash-Sharq daily, al-Iktissad wal aamal group and the group that owns the al-Markaziya agency — for a total of LL1.2 billion (nearly $815,000).

Offices in Paris and business trips

Secondly, the A&M audit notes that between 2015 and 2020, BDL disbursed (in euros) the equivalent of nearly LL6 billion, or $3.96 million to Eciffice (a business center providing workspaces and meeting rooms for small companies), in return for the rental of offices in Paris — a controversial operation that is the subject of international and local investigations.

In fact, BDL signed an office-rental contract with Eciffice in September 2010, which was renewed several times until 2016. Most of the rents BDL paid to Eciffice were later transferred to the owner of the offices, SCI ZEL, a property management company.

Initially led by Raja Salameh (brother of Riad Salameh) until he gave up his shares (1 percent) in 2015 to Anna Kosakova — a former companion of the BDL governor, with whom he has a daughter — SCI ZEI has funds from BET SA, a Luxembourg structure managed by the latter. Following the opening of the Paris investigation, BET SA moved to France. According to a document from the Paris Commercial Court seen by L’Orient-Le Jour, all the company’s shares were transferred to Salameh and Kosakova’s daughter, still a minor at that time, and Kosakova retained rights of usufruct.

During a hearing in Beirut in August 2022, it was disclosed that the BDL governor designated the office space rented in Paris to be an “emergency center for external operations.” Any foreign banking establishment wishing to use its French premises for such a purpose must obtain authorization from France’s central bank. BDL was never granted such authorization, so its Paris offices cannot actually be used as Salameh claimed.

According to the French independent online investigative newspaper Mediapart, Kosakova told French investigators that BDL paid her 4,849,787 euros per year to rent a “100 m²” space, while “the full use of the premises” was limited to “about four weeks a year.”

“The choice of the location, in one of the most expensive avenues in the world, however, is difficult to explain for an office that has no representative function,” a source close to the banking sector who requested anonymity told L’Orient-Le Jour in early 2022.

Third, the report states that during this period, BDL disbursed some LL2.1 billion ($1.4 million) to pay for the governor's business trips and participation in conferences.

Art, luxurious offices, company cars

Fourth, A&M notes certain irregularities in three BDL real estate acquisitions during this period, calling into question the relevance of these investments. The first concerns a property purchased for nearly LL52.3 billion in 2015. The funds were disbursed in foreign currency (nearly $34.7 million) to Ali and/or Fatima Zahraa Naboulsi. Also purchased in 2015, the second property was acquired from Mohammad Hisham Tabara for nearly LL18.1 billion, or $12 million. The third property, recorded as the al-Nahar building (the report’s authors did not specify which one), was bought from the Cooperative Newspaper Company for more than LL13.2 billion ($8.8 million). Payments for the properties were made in 2017 and 2018.

Fifth, the auditors question BDL’s purchase of paintings and works of art for the sum of LL2.7 billion ($1.8 million), during this period, given that “there is no policy governing this type of expenditure, which is entirely left to the discretion of the central council,” and that these acquisitions were “inappropriate” given BDL’s financial situation.

Among those purchases was a wax statue bought for £100,000 (nearly $145,000 at the time) in 2016. The report states that these works were largely purchased either directly from Nada Boulos al-Assaad or from her company, as well as from Maya Joseph Raji, Nicolas Khairallah, and Charbel Joseph Raji.

Finally, the report notes that BDL spent almost LL1.6 billion (almost $1.1 million) to furnish various offices, including that of the governor at the Public Procurement Authority, an institution attached to BDL and chaired by Riad Salameh. The report’s authors note that “the purchased furniture appears to meet personal criteria and to be excessive in nature.”

Finally, Alvarez & Marsal dwell on the acquisition of two company cars for the bank governor — a Jaguar 2016 XJ and a Jaguar 2017 XE — for a cumulative payment of $107,000.

“It is not clear,” the auditors muse, “why the second car ( the XE 2017) was necessary.”

This article was originally published in French in L'Orient-Le Jour. Translation by Joelle El Khoury.