The destruction at Beirut's port, on Aug. 10, 2020, six days after the huge chemical explosion that devastated the Lebanese capital. (Credit: Joseph Eid/AFP)

• According to data compiled by Marta Foresti and Otho Mantegazza at LAGO Collective, a research organization based in London, and calculations done by L’Orient Today, Lebanese are estimated to have lost over $5.1 million in non-refundable fees for rejected visas to four popular travel destinations – Schengen countries, the United Kingdom, the United Arab Emirates and the United States – excluding the extra costs associated with non-refundable hotel and flight bookings, third-party visa handler fees (such as TLScontact and VFS Global), travel insurances, and translation of all required supporting documents for visa applications.

LAGO collective also found that EU governments had collected €130 million (or $138.9 million) in rejected visa application fees in 2023 while the UK had collected some £44 million, or the equivalent of $55.7 million. Low and middle-income countries in Africa and Asia were found to have borne 90 percent of these costs, or over €115 million, the equivalent of over $106 million.

• The Banque du Liban (BDL)’s Central Council published intermediary circulars 697 and 698 on Thursday, approving the renewal of Circulars No. 158 and 166. Set to go into effect on July 1, 2024, the decision will be valid for one year and includes amendments to each circular, meant to allow a larger number of people to be affected by them.

The two circulars are part of a series of circulars that had been issued since the beginning of the crisis in 2019, meant to alleviate the losses incurred by depositors whose funds — worth $70 billion in total — remain illegally trapped in Lebanese banks.

• Caretaker Public Works Minister Ali Hamieh announced on Thursday that, as of next week, Lebanon will begin selling the scrap metal debris left from the deadly Aug. 4 Beirut port explosion. This initiative is part of "reconstruction and rehabilitation" efforts for the port that started last September.

The initiative is expected to free up "more than 150,000 square meters" of land at the port, creating the opportunity for local and international companies to invest in the area.

According to port director Omar Itani, each ton of metal will be sold for "$245." It has been difficult to accurately determine the exact quantity of metal debris at the port. However, based on aerial images, the estimated range is between 9,000 and 25,000 tons of scrap metal, Itani told L’Orient Today.

• According to figures put forward by Banque du Liban (BDL) 609,896 loan borrowers benefited from Lebanon's economic crisis, repaying the equivalent of $58.5 billion in loans (dominated in lira or US dollars) between October 2019 and April 2024. Nearly 89.4 percent of the total amount has been repaid at prices lower than the initial value.

Businesses were also found to have benefited from the situation. In September 2023, according to BDL’s latest statistics, individuals repaid the equivalent of $18 billion in personal loans (90.4 percent of the sum in September 2019), while the private sector relieved itself of almost $35.3 billion in loans (77.6 percent of the initial sum). In terms of activities, companies in the trade and services sector led the way ($18.1 billion repaid), ahead of those in the construction and manufacturing fields ($7.7 billion and $5.6 billion respectively).

Banks, short of liquidity and in the absence of any laws that ensure new loans granted would not be repaid in lollars, ceased lending money, leading to a sharp drop in the number of borrowers. At the end of September 2023, only 29.5 percent of them, mainly individuals, still had loans to repay.

• Tarek Khalifeh, CEO of Creditbank, appeared on Wednesday before Jamal Hajjar, acting public prosecutor at the Court of Cassation, following a report submitted to the magistrate a fortnight ago by the Banque du Liban's (BDL) Special Investigation Commission (CSI), which alleges the bank has breached the law. According to an informed source contacted by L'Orient-Le Jour, the bank has a budget deficit of around 309 million bank dollars (commonly known as "lollars," at the current rate of LL15,000 per dollar), which could be due to financial mismanagement or embezzlement.

Accompanied by his lawyer Marc Habka, Khalifeh presented Judge Hajjar with a copy of a draft settlement that he is currently negotiating with BDL, the source told L'Orient-Le Jour. The arrangement would involve Creditbank settling approximately $33 million in "fresh" funds — which can be withdrawn and transferred at their real value, at the current market rate of LL89,600 — to cover the $309 million bank deficit. Negotiations with BDL should produce a result "within the next 10-15 days," the source said. “If necessary, all legal proceedings relating to this matter should be dropped.”

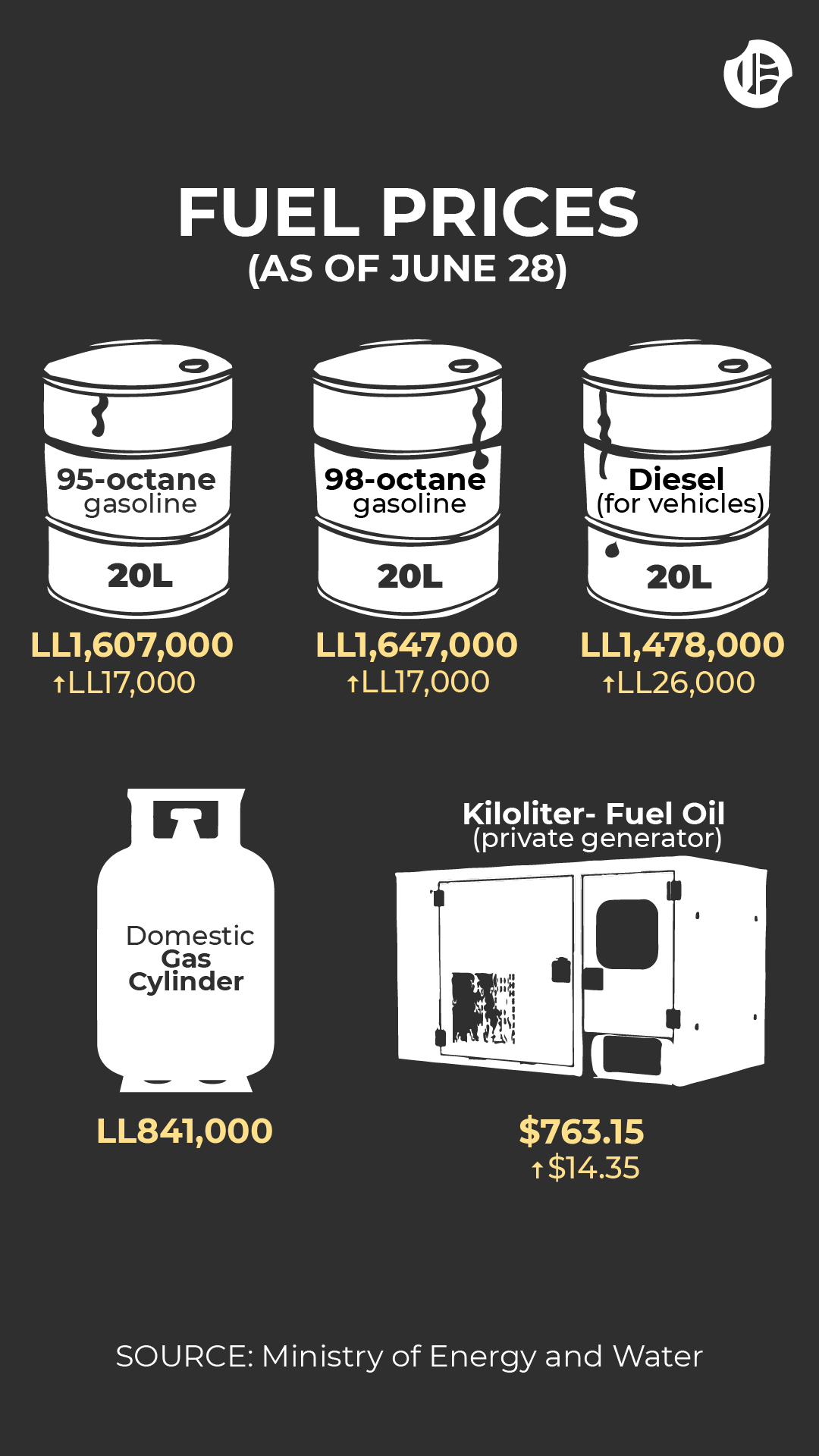

• The price of gasoline and diesel increased slightly while the cost of fuel oil for private generators increased more significantly, according to the latest price list published by the Energy and Water Ministry. Here are the new rates:

Analysis of the week

From 2020 to 2023, the sums present in the accounts of millionaires fell by 44 percent. Read Mounir Younes’ piece: