A man counts Lebanese lira banknotes at a currency exchange shop in Beirut, Lebanon, Jan. 5, 2022. (Credit: Mohamed Azakir/Reuters)

BEIRUT — Among the indicators in the World Bank’s Fall 2022 Lebanon Economic Monitor that illustrate the depths of the country’s economic crisis, there is one with particular salience when it comes to the future of the Lebanese state.

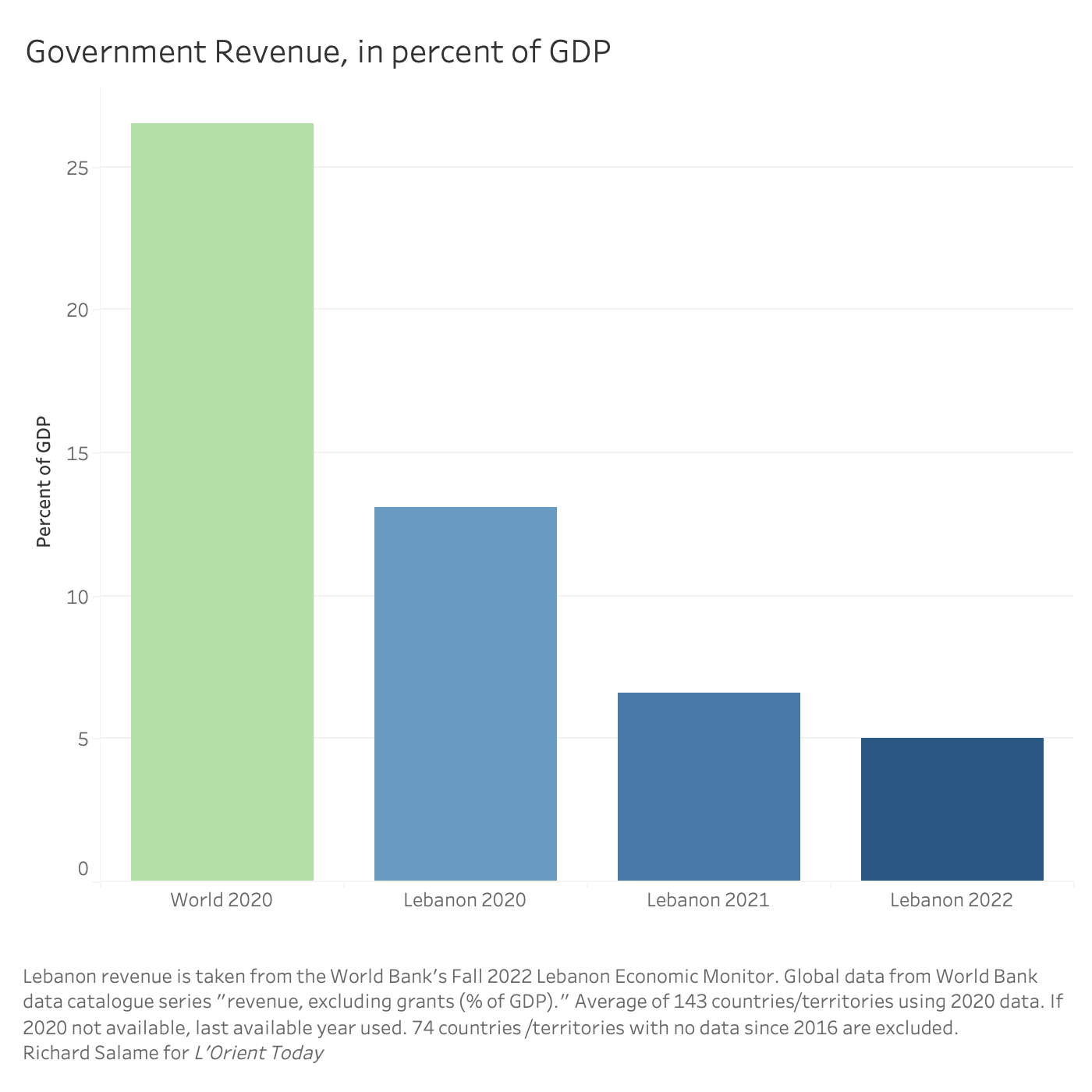

“Revenues are estimated to have declined from an already low 13.1 percent of GDP in 2020 to 6.6 percent of GDP in 2021, among the lowest rates globally,” the Lebanon Economic Monitor reported.

This is the lowest level of revenue collection relative to the size of the Lebanese economy since 1990, according to World Bank data.

The data underlines the dire financial straits of the state, which struggles to pay its employees’ meager salaries, let alone provide quality services to the public and deliver badly needed social protection programs.

Even existing social benefits in healthcare, social insurance and education are being reneged upon when they are needed most. A global comparison shows just how low Lebanon’s revenue collection has fallen.

A L’Orient Today analysis of global World Bank data from 2020 (or the most recent available year for countries where 2020 data is not available), found that, on average, governments collected 26.5 percent of their respective GDPs in revenue.

Single-digit government revenue collection falls far below what even the World Bank — which has historically been accused by critics of using its weight to promote privatization, austerity and government downsizing — recommends.

“Countries collecting less than 15% of GDP in taxes must increase their revenue collection in order to meet basic needs of citizens and businesses,” according to the World Bank website. “This level of taxation is an important tipping point to make a state viable and put it on a path to growth.”

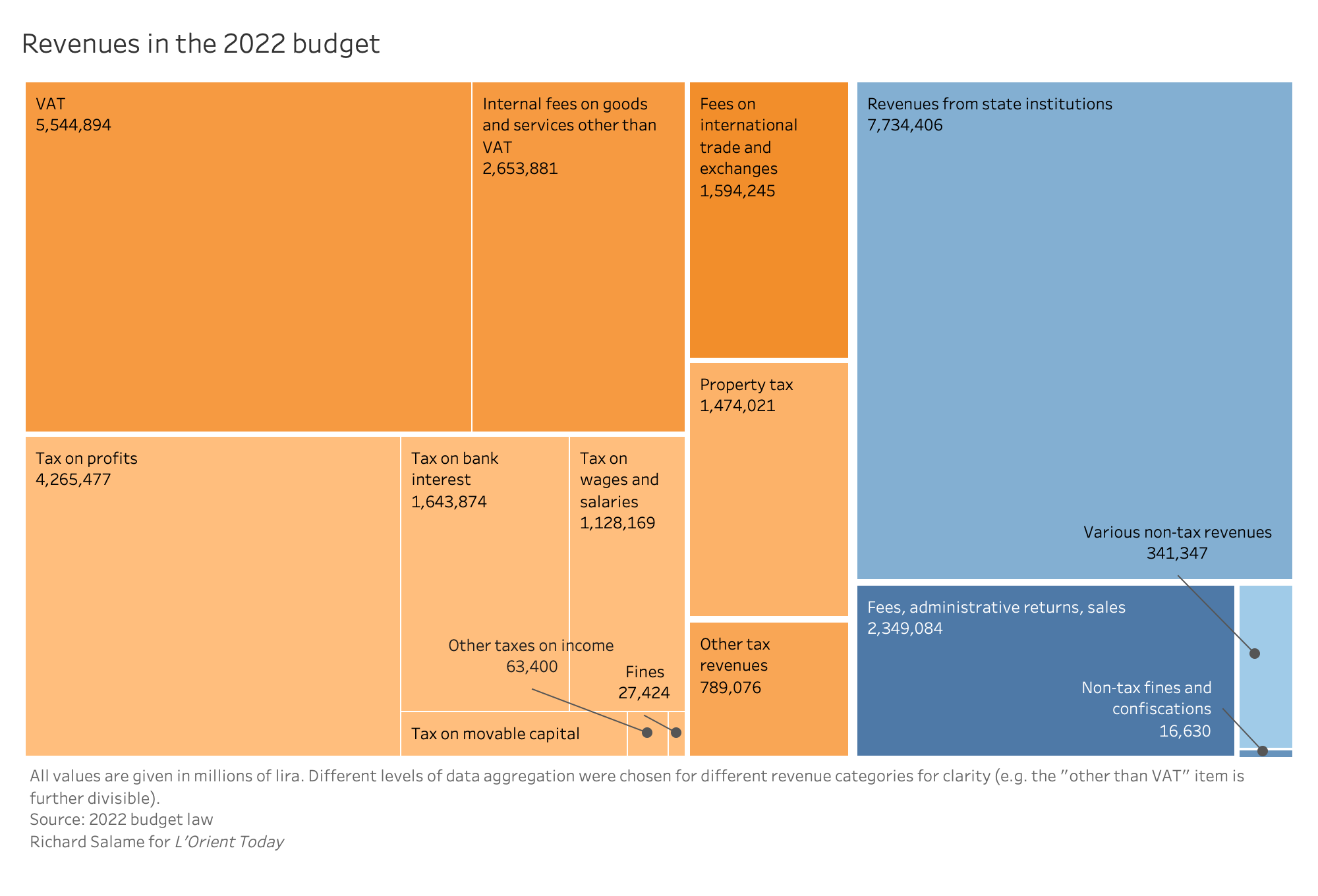

The low revenue rates of 2021 were repeated in 2022, according to World Bank estimates. Lebanon’s 2022 budget projected state revenues of LL29.99 trillion against spending of LL40.87 trillion, for a deficit of LL10.89 trillion.

This results in revenue of five percent of 2022 GDP, based on World Bank projections of a 5.4 percent GDP contraction in 2022 compared to 2021.

An unfair tax system

Of those revenues, just LL1.1 trillion is projected to come from a progressive tax on individuals’ wages and salaries, despite the highly contentious increases that were included as part of the budget.

Conversely, a regressive VAT tax accounts for LL5.5 trillion. Flat taxes, like a value-added tax (VAT), place a proportionally higher burden on low-income people because they must spend a larger chunk of their income as opposed to saving it, which incurs no VAT.

Analysts see a lack of vision for the economy in Lebanon’s 2022 budget, and a lack of recovery planning. Instead, critics claim it is a stopgap measure to keep the civil service hovering just above collapse.

“The revenue structure post-crisis continues to be inequitable,” said Sami Zoughaib, an economist at Lebanese think tank The Policy Initiative.

“Instead of trying to work toward rebuilding our revenue structure and making it more efficient, making it raise more funds that can fund sustainable social protection measures, we do seem to opt for a revenue structure that is completely out of touch with reality, that does not make any sense whatsoever [and] that is purely built in a way that allows the state to pay the civil servants,” said Zoughaib.

The state’s tax base is the country’s shrinking economy. There is less income and profit available for taxation than previously in an economy that is less than half its pre-crisis GDP. The state is highly reliant on a VAT that brings in less money as consumption falls dramatically.

“A major reason for the decline in government revenue is that Lebanon’s tax system does not adjust to inflation,” former economy minister and central bank vice governor Nasser Saidi told L’Orient Today. By way of example, he cited customs.

Prior to Dec. 2022, customs duties — a major component of state revenue — were fixed at the LL1507.5 exchange rate, leading to a more than 95 percent reduction in the real value of state revenues since Oct. 2019 as the lira depreciated. In December, customs were converted to LL15,000 per dollar; roughly a third of the real lira value of the import at the current parallel market rate.

Saidi said that, as part of overall reforms, Lebanon needs to adjust its tax system to protect revenues from inflation. “For example, the so-called ‘customs dollar’ should be abolished and tariff rates should apply to the foreign currency value of the goods and [be] paid in foreign currency,” he said.

“All taxes will have to be adjusted for inflation so that [the] government has revenue to cover core spending,” Saidi added.

The 2022 budget, published on Nov. 15, 10 and a half months into the year, converted a number of taxes and fees to foreign currencies, such as consular fees, port fees and airport fees, as well as some capital gains and interest income taxes.

Other factors that have driven the sharp decrease in revenue include increased tax evasion amid a growing cash economy and less effective tax administration, as well as less revenue from taxes on bank interest as deposits decline.

Saidi called the state’s ability to collect taxes “sharply impaired” and said anecdotal evidence suggests tax evasion has “substantially increased.”

Zoughaib pointed to the regressive nature of the tax system, and the low taxes enjoyed by society’s most privileged, whose large dollar earnings have been taxed at a much lower lira rate the past three years.

“We need to introduce the concept of equity, of making sure that there’s an equitable sharing of the burden of financing the state across the segments of society,” he said. “To this day there are people who are making money, capital gains in Lebanon, on investments they have abroad and paying no taxes on it, or taxes at the LL1,500 rate, which is [effectively] no taxes.”

“Instead of trying to subsidize people by lowering taxes universally, make sure that you are raising the necessary revenues that you should be raising through tools that are more equitable, that are progressive and then target those who are most vulnerable [and] offer universal social benefits… that would protect people much more than if we were protecting them by making sure they are paying virtually no taxes,” Zoughaib added.

“Those who are in the high echelon of the social scale in Lebanon are living in a tax haven currently. And this can be rectified by thinking more progressively about fiscal revenues.”