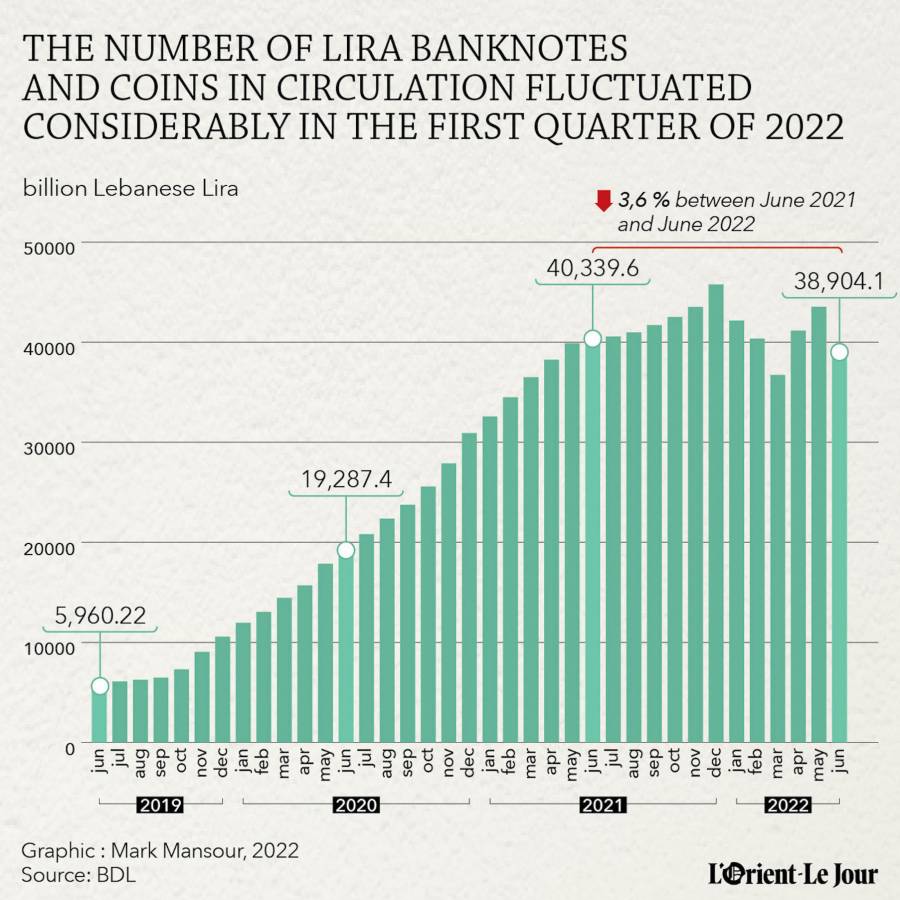

BEIRUT — The total number of lira notes and coins in circulation declined at the end of June, from LL 40,339.6 billion in June 2021 to LL 38,904.1 billion in the same period in 2022. This decline is more pronounced if we take into account the figures for the end of 2021, consisting of a 15 percent decrease (LL 45,761.3 billion).

This decrease since December can be explained by Banque du Liban’s circular No. 161, which allows economic agents to withdraw their lira in dollars at BDL’s Sayrafa platform rate — which at the end of last week was over LL 26,000 to the dollar, while the rate on the parallel market exceeded LL 33,000. This measure has most likely reduced the number of lira notes and coins in circulation in the economy, pushing agents to obtain US dollars. The greater the supply of a currency, the more it depreciates and the national currency has lost more than 95 per cent of its value since the crisis began. According to the bi-monthly balance sheet published by the BDL, coins and notes in circulation reached LL 43,643.3 billion, an increase of 8.2 per cent in two and a half months, according to our calculations.

Adding sight book accounts (which are not blocked), the M1 aggregate of money supply increased to LL 56,215 billion at the end of June 2022, also down by 3 per cent year-on-year (LL 57,937 billion). The M1 aggregate followed the same decline as the cash money supply, showing the development of the “cash economy” due to a decline in confidence in the Lebanese banking sector. By late summer 2019, banks had imposed restrictions on foreign transfers and withdrawals from foreign currency accounts, and Banque du Liban began “lirifying” a portion of deposits since April 2020 through Circular No. 151, which allows Lebanese dollars, or “lollars,” to be withdrawn at a rate well below the market rate (currently at LL 8,000).

The total money supply in the economy (also taking into account term accounts in lira, as well as foreign currency accounts and debt securities in circulation outside the financial sector), the M3 aggregate, declined more sharply, by 5.2 per cent year-on-year at the end of June. Foreign currency deposits reached LL 116,494 billion at the end of the first half of the year (at the official exchange rate of LL 1,507.5 to the dollar), a decline of 8.2 per cent. In mid-July, the BDL also restricted card payments in dollars through circular no. 629 of July 19.