Soldiers roll away a flaming tire following protests over Lebanon’s economic crisis outside the BDL branch in north Lebanon (Credit: Fathi Al-Masri/AFP)

BEIRUT — If you aren’t a Lebanon-focused financial analyst or economist, it’s probable you’ve never scrutinized the central bank’s fortnightly balance sheet publication. But, aside from officials’ occasional comments to the media, this statement is the only public disclosure of BDL’s financial health, making it one of the few tangible means by which to assess the trajectory of the country’s financial woes.

L’Orient Today delves into these statements, explaining what they reveal, and, perhaps more importantly, what they may hide.

What’s in a balance sheet?

Banque du Liban’s balance sheets provide information on the central bank’s assets, liabilities and equity, and thus offer insight into its future earnings capacity.

Anything capable of being owned or controlled to produce value is considered an asset while liabilities are what the organization owes, such as debts owed to creditors.

Equity in the case of BDL represents the public’s ownership of assets, such as the central bank’s capital.

A balance sheet should always balance. The name “balance sheet” is based on the fact that assets will equal liabilities plus equity, every time.

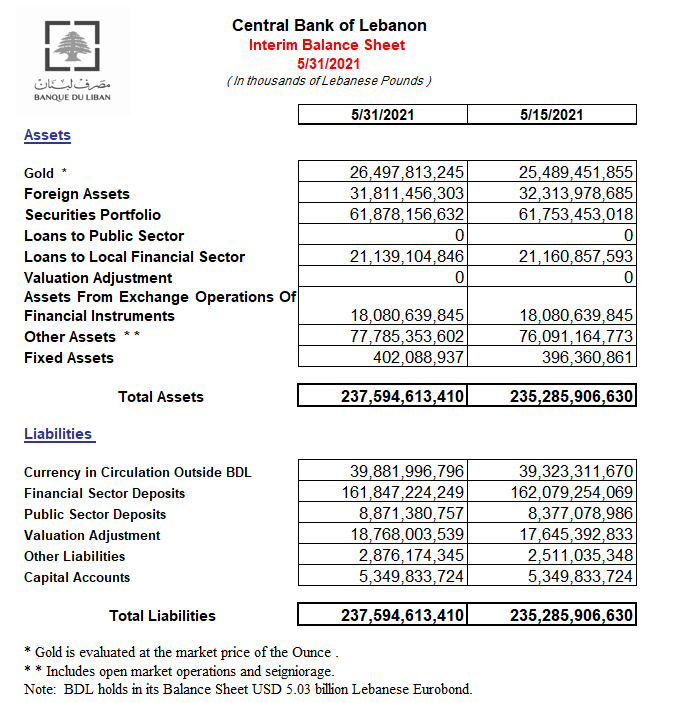

BDL's latest interim balance sheet. (Source: Banque du Liban)

BDL's latest interim balance sheet. (Source: Banque du Liban)

The components of BDL’s balance sheet are reported in Lebanese lira and the dollar entries are recorded in lira at the official LL1,507.5 exchange rate to the dollar — so in reading the balance sheet there is no need to get tangled up in the mental gymnastics of Lebanon’s multiple exchange rates.

Assets: What does BDL say it owns?

The bank’s main holdings consist of some 286.6 tons of gold reserves, foreign assets, a securities portfolio and what it describes in its balance sheets as “other assets.”

The top line of any BDL balance sheet line tells us the value of the gold it holds — about $17.58 billion worth, according to the latest sheet, making it one of the largest gold reserves in the Middle East and North Africa region.

However, although the quantity of BDL’s gold reserves remains unchanged — in 1986, MPs prohibited the sale of the gold resources held by the central bank unless Parliament passes a law to do so, and it has never passed such a law — the physical presence of much of those reserves has not been publicly verified in recent years.

Audited financial statements and an auditors’ report produced by Deloitte and Ernst & Young in 2018 and seen by L’Orient Today show that the auditors were unable to conduct a “physical inventory observation” of about 60 percent of the gold held by the bank, due to “limitations related to a complex accessibility policy which gives access exclusively to top executives of the bank.” Indeed, in December, parliamentarians said that these restrictions placed on auditors mean that a significant portion of BDL’s gold reserves has not been counted since 1996.

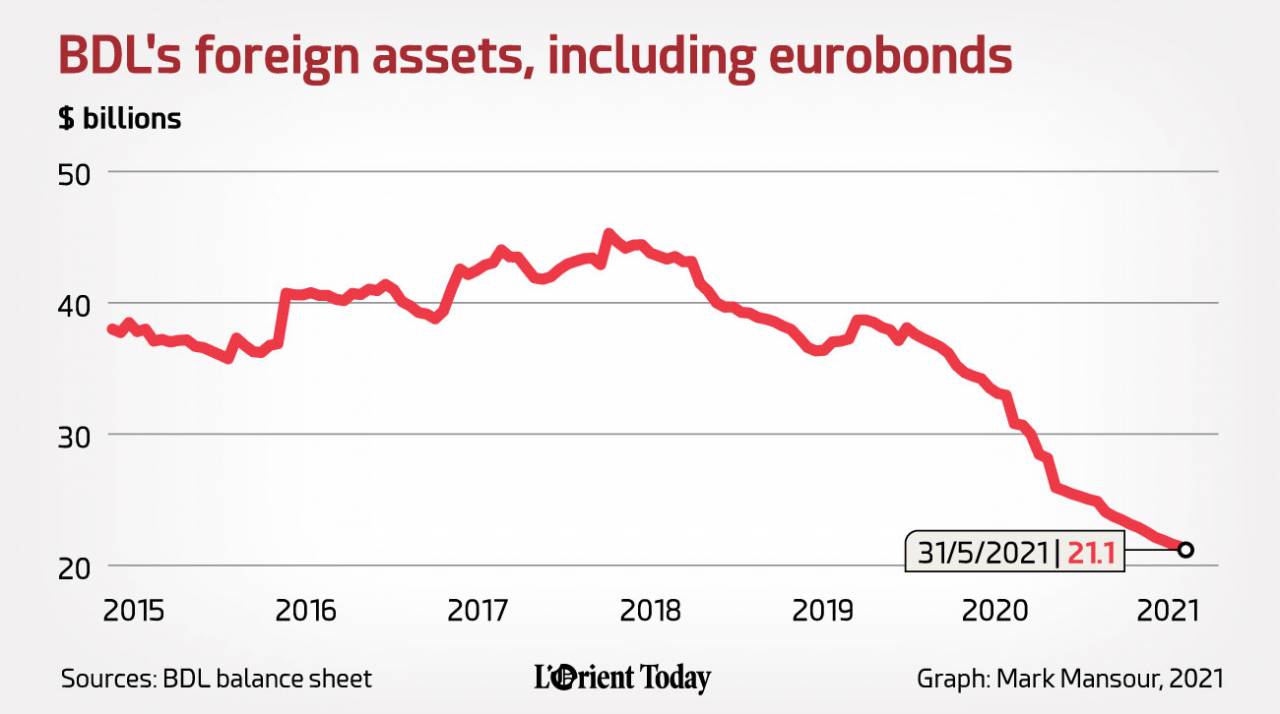

Just below the gold reserves is perhaps the most talked-about line in the balance sheet: BDL’s foreign assets — more commonly understood as the pot from which subsidies on essential imports are propped up. These assets mainly consist of dollar reserves, foreign currency loans to banks and government eurobonds — loans to the government in hard currency — and are now valued at $21.1 billion. However, that figure includes $5.03 billion in eurobonds, on which Lebanon has defaulted.

The bank’s foreign assets, valued at $42 billion at the start of 2018, have been continually decreasing from balance sheet to balance sheet, falling by around $539 million in May alone.

The balance sheet does not provide a specific figure for BDL’s foreign currency reserves, which were valued at $15.8 billion at the beginning of April, according to caretaker Finance Minister Ghazi Wazni’s comments to Reuters.

Although L’Orient Today reached out to the central bank governor’s office multiple times requesting details of the bank’s reserves, BDL offered no information regarding the amount of foreign currency reserves it holds or the amount of mandatory dollar reserves commercial banks had placed at the central bank.

The third asset line shows you the value of the central bank’s “securities portfolio,” which in BDL’s case mainly refers to its holding of treasury bills — loans to the government in lira. The value of this portfolio stands at LL61.88 trillion.

The line below provides the amount of “loans to the public sector,” i.e. loans to government agencies and state-owned enterprises. This accounting entry has been null since July 2013. This does not mean that the central bank has stopped lending to government bodies, just that these loans are most likely registered in the “securities portfolio.”

Meanwhile, the following line presents the total “loans to the local financial sector” — an asset mainly representing the unsettled sum of money in lira BDL has loaned to commercial banks, a key component of BDL’s controversial financial engineering operations. This line is valued at LL21.14 trillion.

The line below this is called “valuation adjustments,” which reflects the change in the value of the bank’s gold and foreign currencies compared to their historical purchase price, according to Article 115 of the Code of Money and Credit. This entry has been null in the assets section since 2011, but it has been increasing on the liabilities side, reaching about LL18.77 trillion, mirroring the increase in gold prices on the international market over the years.

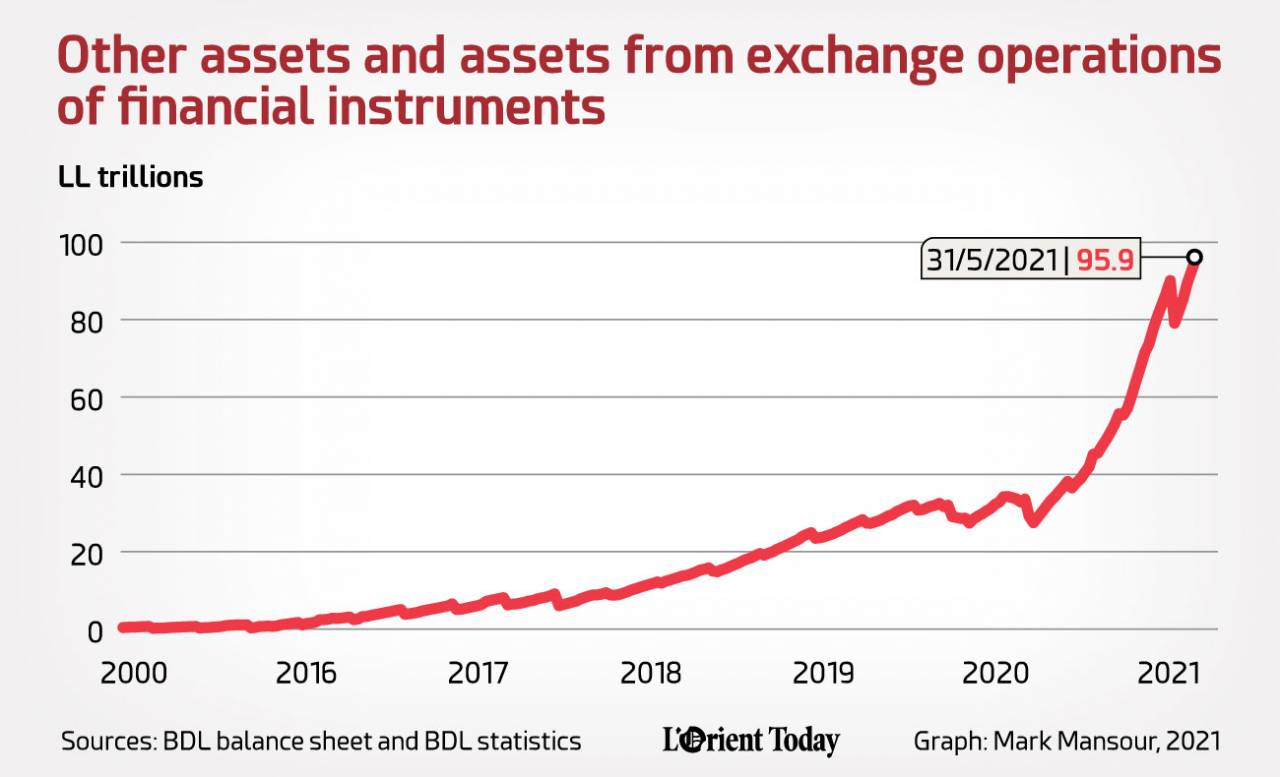

Next comes “assets from exchange operations of financial instruments” — an entry that portrays transactions conducted by BDL to preserve the official LL1,507.5 peg to the dollar. These transactions were registered in the “other assets” entry up until November 2015, when BDL separated this line in its books into two entries. The line has been stable at about LL18 trillion since 2018.

This LL18 trillion represents losses “resulting from years of loss-making financial transactions operated by BDL, aiming to defend the peg,” the Lebanese government’s Financial Recovery Plan revealed in April 2020.

Next, the central bank’s accounting manager registers a mysterious figure: LL77.8 trillion in an entry with the uninformative title “other assets.” BDL says that this entry includes “open market operations” and “seigniorage” — profits made by the central bank from the difference between the value of an issued banknote and the cost of printing it. What else the figure includes is unclear.

As early as August 2019, ratings agency Fitch cast doubt on this line, saying it “may partly represent an accounting balancing item.”

Andy Khalil, an economic researcher and commentator, is more blunt. “This account illustrates losses registered on BDL’s balance sheet,” he told L’Orient Today.

Lastly, BDL’s fixed assets — land, property, machinery and equipment — are valued at about LL402 billion, according to the latest BDL balance sheet.

The sum of Banque du Liban’s total assets is LL237.59 trillion.

Liabilities: What does BDL owe to stakeholders?

BDL’s liabilities mostly comprise deposits at the central bank and printed Lebanese lira outside the central bank.

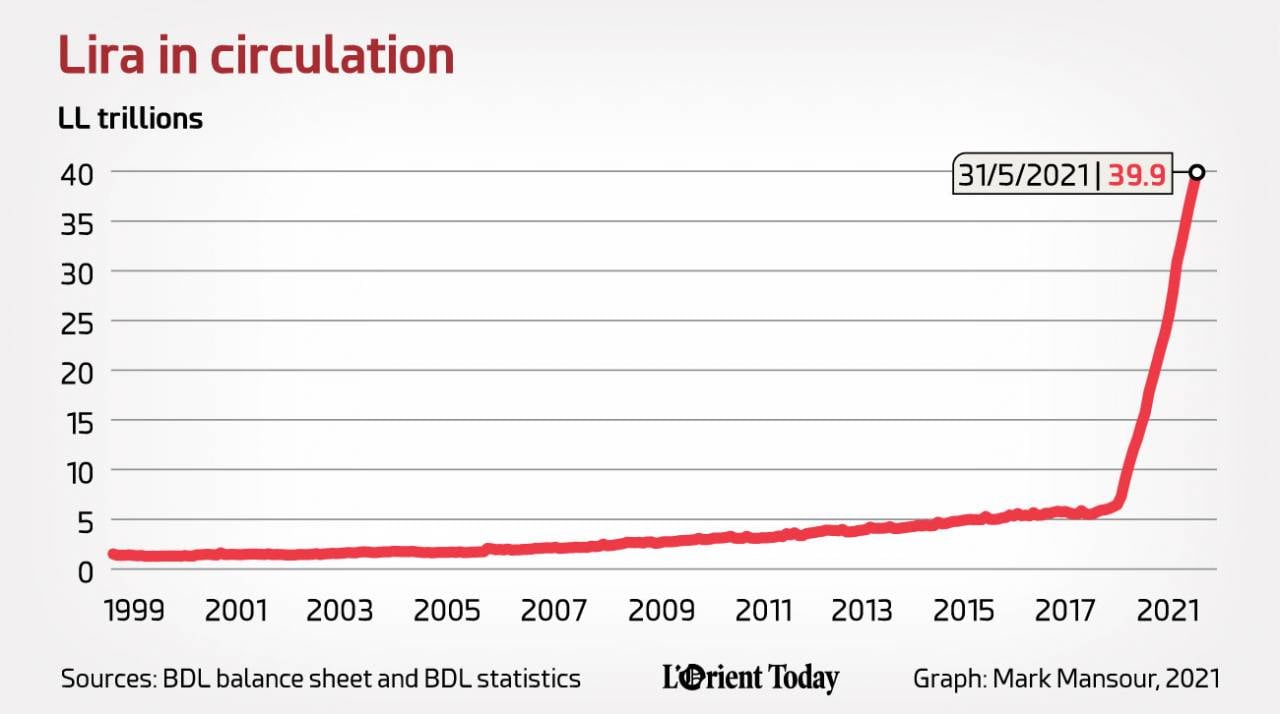

The first line on this side of the balance sheet shows you that the quantity of physical “lira in circulation outside BDL” — a liability on BDL’s balance sheet — has increased by more than six times since the beginning of summer 2019, when cracks first started appearing in Lebanon’s “resilient” banking sector.

The currency in circulation rose from some LL5.9 trillion in June 2019 to about LL39.9 trillion on May 31.

“This amount has been increasing at an accelerated rate mainly due to the differential between BDL’s exchange rate of LL3,900 on US dollar deposits and the official peg of LL1507.5,” Khalil said. The central bank has to print 2.6 times more lira banknotes just so that US dollar deposit withdrawals can be fulfilled.

The second line on the liabilities side shows that the “financial sector deposits” at BDL, a liability owed to commercial banks, are worth LL161.85 trillion. These funds represent depositors’ money, in lira and foreign currencies, that banks placed at the central bank, often earning high interest rates.

Right below this, you can find “public sector deposits” at BDL, a liability owed to public institutions, which are worth LL8.87 trillion. This entry shows public sector deposits at the central bank, most of which are placed as demand deposits — money that can technically be withdrawn at any moment, earning low or zero interest. The state generally uses these demand deposits to move funds between the Finance Ministry and other ministries and state entities.

And under this figure is a “valuation adjustment” registry for BDL’s liabilities that mirrors the increase of BDL’s gold value over the course of time in comparison to its purchase price. Due to legal reasons, this is recorded as its own line in BDL’s liabilities, standing at LL18.77 trillion.

“Other liabilities,” a mirror image of the “other assets” entry, which reportedly includes some unused seigniorage and accrued expenses, is currently worth LL2.88 trillion.

The last entry on the liabilities side includes Banque du Liban’s capital, which represents the book value of the bank: currently, LL5.35 trillion.

At the bottom of the balance sheet, you can see that total liabilities and equity are added together to come up with LL237.59 trillion, which balances with BDL’s total assets.

Behind the balance sheets

Up until the first whistleblowers heralded the onset of the financial crisis in mid-2019, BDL’s balance sheets successfully hid an unsettling reality. On the surface, the numbers looked fair, but what was happening underneath those numbers, it would transpire, was cause for considerable concern.

In a financial recovery plan published in April 2020, Lebanon’s government reported losses worth LL241 trillion in the financial sector, out of which about LL177 trillion were incurred on BDL’s balance sheet — an amount “that compares to no other case in the world,” the government’s plan highlighted. Despite losses being discussed by several analysts over the years, the plan issued in April 2020 was the first official report to reveal these hidden losses.

These losses are not clearly reported in BDL’s bi-weekly balance sheets, as the bank presumes it is exempted from some international accounting standards, according to the auditors’ report, and is therefore allowed to use unconventional entries without registering them as losses.

“The most significant accounting policies applied by the bank differ from the relevant applicable international financial reporting standards,” the auditors said.

In order to accumulate dollar reserves to maintain the lira peg to the dollar and to finance imports, BDL offered increasingly higher interest rates and upfront profits to commercial banks through financial engineering operations to encourage banks to place their customers’ dollar deposits at the central bank.

Banks took the bait and shifted most of their dollar liquidity from their correspondent banks abroad — where they had placed significant deposits in the 1990s and early 2000s — and invested the funds as deposits with BDL.

The incentive to deposit the funds at BDL was plain: excessive interest rates and profits offered by the central bank to attract commercial banks’ hard currencies. “Banks were offered sizable incentives to participate in the [financial engineering] operations,” the International Monetary Fund said.

The financial engineering operations in 2016 resulted in about a $5 billion injection into banks “without any equity stake in return,” the IMF stated at the time, underlining that “a few banks also passed on part of their income to high net-worth depositors by offering very attractive rates on sizable deposits.”

Therefore, commercial banks brought their money back to Lebanon and placed it at BDL. The funds can be found in the liability “financial sector deposits” record at BDL, which grew by nearly 60 percent between 2016 and 2018, rising from about LL113 trillion to LL180.57 trillion.

For a balance sheet to balance, the accounting manager has to record all transactions in at least two different accounts and make sure that total assets are equal to all liabilities plus equity. The above change increases total liabilities and should be mirrored by an increase in assets.

Through financial engineering operations, the asset “loans to the local financial sector,” which represents the money lent to commercial banks, rose by about seven times, from about LL7 trillion in August 2016 to LL48.6 trillion at the end of 2018.

In addition, the main outcome of absorbing depositors’ money at commercial banks was a temporary increase in BDL’s foreign assets since commercial banks deposited their clients’ dollars at BDL. Those foreign assets reached a record high of $42 billion in December 2017 — $6 billion higher than the previous year.

However, “this policy was unsustainable and costly,” Mike Azar, a debt finance advisor, told L’Orient Today.

Concerns over sky-high interest rates, negative outlooks from credit rating agencies and political instability in the region over the past decade led to dwindling dollar inflows and an increase in outflows. In addition, financing imports at the official peg for years — a policy that now drains some $500 million per month under the current subsidy program — diminished BDL’s foreign assets.

Thus, these assets have significantly dropped since 2017, falling to around $17.1 billion at the end of March, when the $5.03 billion in eurobonds on which Lebanon defaulted are excluded.

“When the actual goal of financial engineering operations was to attract dollars into the economy, it ended up doing the exact opposite,” Khalil said.

Are the books cooked?

A quick look at one of BDL’s balance sheets does not fully reveal the central bank’s financial position, but examining the bank’s balance sheets over the years alongside the leaked auditors’ report indicates a set of entries in which its losses could be concealed.

In fact, a significant share of “loans to the local financial sector” represent incentives to banks to participate in financial engineering operations, where what effectively happened was that banks received loans from BDL at a low interest rate and deposited the same funds with BDL at a higher rate, making a profit out of interest rate differentials, Azar said.

A part of financial engineering was conditional on attracting fresh dollars; BDL was giving loans in lira worth 1.25 times the fresh dollars deposited at the central bank, Khalil said.

For example, if a bank deposited $100 million in fresh currency at the central bank, BDL allowed the bank to receive a loan worth $125 million but in lira. BDL was handing those loans to banks at low interest rates — about 2 percent — while banks were depositing their dollars at BDL at a higher interest rate — around 12 percent, making 10 percent profit out of this operation.

“In simple terms, this means that Banque du Liban was printing lira to profit banks,” Khalil told L’Orient Today.

The financial engineering exacerbated losses at the central bank in favor of profits handed to banks in lira, which were used to buy real dollars at the official exchange rate, he added.

BDL was not generating enough income to cover these operations; therefore, the governor had to cover BDL’s expenses through “seigniorage,” which means by creating new money.

But “BDL cannot create dollars,” Azar said. Seigniorage is in lira, while a substantial portion of BDL’s liabilities is in hard currencies.

BDL’s leaked audited financial statements show an asset item called “seigniorage on financial stability,” valued at LL10.27 trillion on Dec. 31, 2018. How this amount was reached is a mystery since “the [central bank] governor [himself] determines the seigniorage amount resulting from financial stability as deemed appropriate by him,” the auditors wrote.

The seigniorage is registered in the “other assets” item in the balance sheets, but in reality it mostly portrays losses carried by BDL.

These losses accelerated during the financial engineering operations executed from May to August 2016 “by providing profits to commercial banks that outweighed the income of the central bank,” Khalil said.

“These losses were hidden on the balance sheet in the form of “other assets,” or future revenues since the central bank does not follow international accounting standards to report losses. That’s why the losses were only revealed to the public at a later stage,” Azar said.

Another unconventional accounting entry is “assets from exchange operations of financial instruments,” valued at about LL18 trillion, which represents losses resulting from financial transactions operated by the central bank, as referred to in the government plan.

In April 2020, BDL Gov. Riad Salameh supported his bank’s financial reporting, saying that the bank does not consider these figures as losses and that BDL can carry forward the losses — transfer them to subsequent years — and gradually write them off against future revenues.

However, the other assets entry has been steadily increasing over the years, indicating that BDL has not been on a path toward covering these losses, the government plan reported.

And these losses are important because, in short, “central bank losses are the people’s losses,” Khalil said.