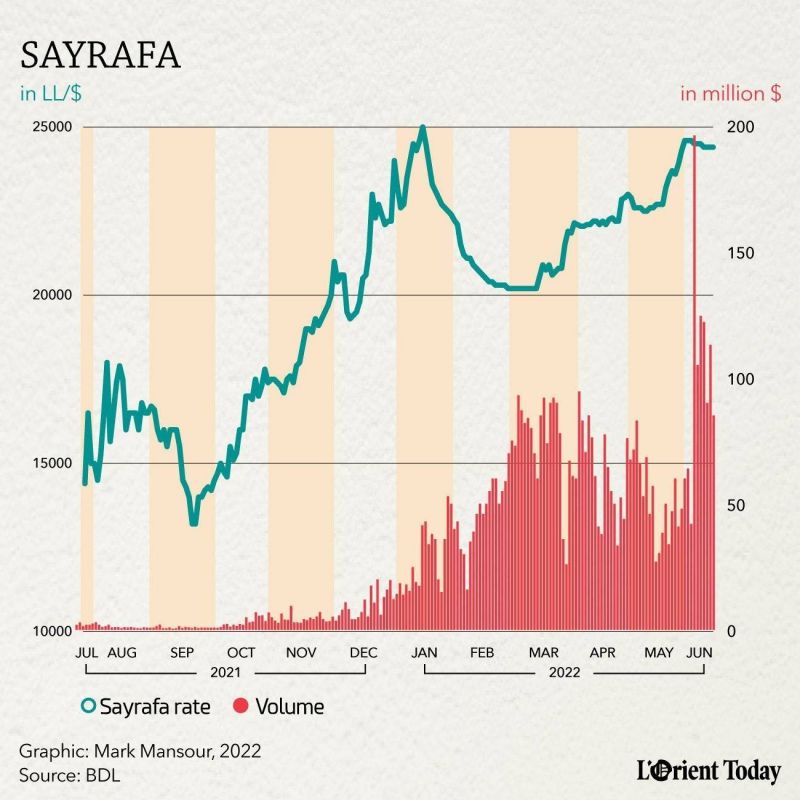

The fluctuation of the Sayrafa rate per volume of transactions in 2021 and 2022. (Source: Banque du Liban)

The Lebanese lira lost eight percent of its value in less than 48 hours, trading below LL30,000 to the US dollar, after the central bank tightened requirements on Sayrafa transactions today.

Here’s what we know:

• The amount recorded yesterday on the Sayrafa platform dropped by half to $55 million from levels of more than $100 million reported on June 9 and June 10.

• Bankers confirmed to L’Orient Today that the central bank is limiting access to US dollar banknotes. In turn they have reduced clients’ quotas and introduced new requirements on those wishing to benefit from the advantageous rate such as a minimum account size, salary domiciliation, and a history of similar transactions in the account. They are also requiring commercial clients to provide copies of invoices and proof of funds. The applications are then forwarded to the central bank for final approval.

• Some bankers told L’Orient Today that they are calling back their commercial clients to withdraw the deposits made in the previous days in Lebanese lira since the exchange requests will not be processed.

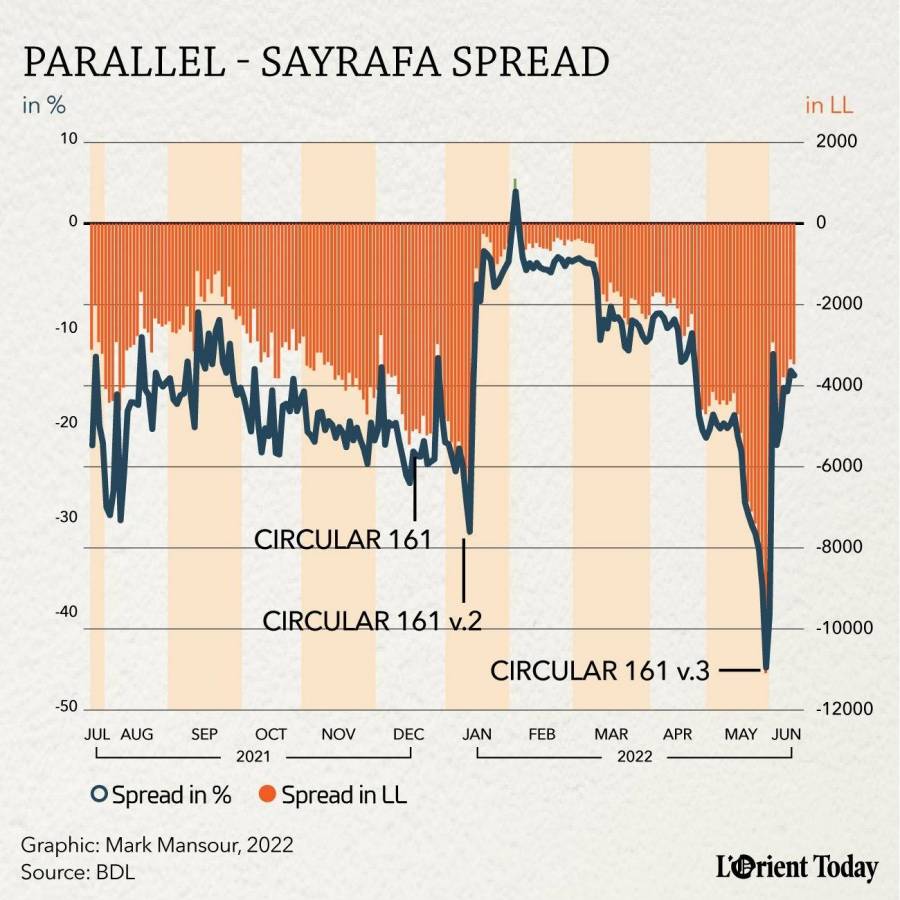

Spread between the parallel market rate and the Sayrafa rate (in LL and percentage) at various periods of updates to Circular 161. (Source: Banque du Liban)

Spread between the parallel market rate and the Sayrafa rate (in LL and percentage) at various periods of updates to Circular 161. (Source: Banque du Liban)

• Sources at the central bank told L’Orient Today that the new measures are to curb the excessive speculation on the US dollar by limiting the amounts processed by banks. The sources indicated that some clients were taking advantage of the spread between the Sayrafa rate and the parallel market rate and were engaging in arbitrage trades by buying dollars at LL24,700 to the US dollar and selling it to money exchangers at a more favorable rate. The source continued that these transactions are not related to trade or to any other critical economic activity.

• The central bank will release tomorrow its bimonthly balance sheet, which should show the drop in foreign currency reserves during the last 15 days as well as the amount of lira in circulation.

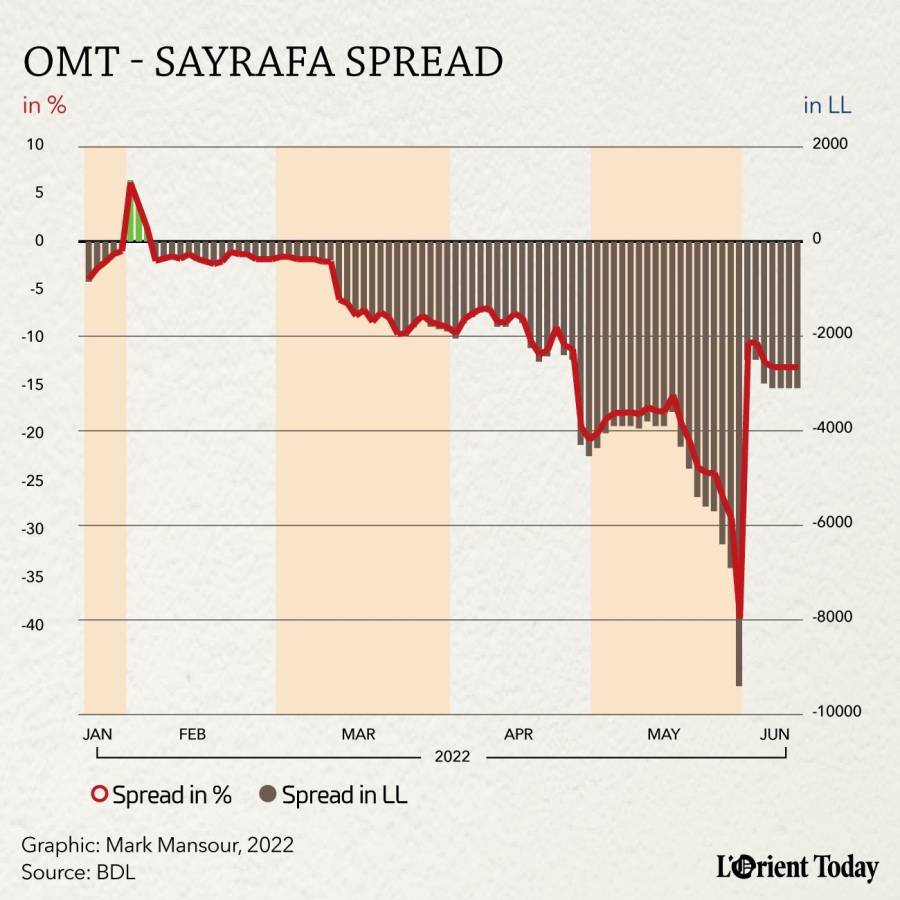

Spread between OMT rate and the Sayrafa rate in LL and percentage. (Source: Banque du Liban)

Spread between OMT rate and the Sayrafa rate in LL and percentage. (Source: Banque du Liban)