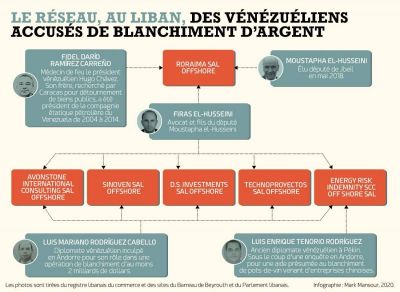

BEIRUT — Days after the Oct. 17, 2019, protest movement erupted, MP Moustafa El Husseini proclaimed his support for transparency and vowed to lift banking secrecy on his accounts, but neglected to publicly disclose that he and his son established firms with a group of Venezuelans implicated in industrial-scale money laundering.

L’Orient Today has learned that the parliamentarian and his son, Firas El Husseini, are part of a mysterious web of offshore companies in Beirut, whose co-owners included the brother of a fugitive former head of Venezuela’s state-owned oil company and a businessman indicted in Andorra for a multibillion-dollar criminal scheme.

Firas El Husseini, an attorney who specializes in company law, said that he served only as a lawyer for the Venezuelans to open the firms in Lebanon, but had nothing to do with any of their possible activities. Husseini emphasized that he held nominal, 1 percent shareholdings in the firms he established on behalf of his clients.

As for his politician father’s involvement, the attorney told L’Orient Today that he was added as a nominal, 1 percent shareholder of a company solely for the purposes of fulfilling Lebanese legal requirements for the minimum number of owners of a firm.

“My father has nothing to do with the whole matter,” Firas El Husseini said. The MP did not answer multiple phone calls.

A trail of corporate and legal documents as well as media reports reviewed by L’Orient Today show that the Venezuelan co-founders of the offshore firms with the Husseinis have been caught up in money laundering prosecutions in Venezuela, the US and Andorra. None could be reached about why they opened offshore firms in Lebanon.

“They were never involved in activities related to Lebanon,” Firas El Husseini said, claiming that he was not aware of any wrongdoing on the part of the Venezuelans as their legal woes came after most of the Lebanese firms were dissolved.

In September 2018, a judge in the Iberian microstate of Andorra pressed charges against 28 individuals for laundering over $2 billion through Banca Privada d’Andorra. While the indictment remains under seal, the names of the defendants and details of the scheme have leaked to the press.

According to local daily Diari d’Andorra, the indictment alleges that the conspirators used their influence during Rafael Darío Ramírez Carreño’s tenure as president of Petróleos de Venezuela, SA (PDVSA) from November 2004 to September 2014 to receive kickbacks for contracts signed by the state-owned oil giant with foreign companies, including ones in China.

These illicit proceeds were then allegedly routed through Banca Privada d’Andorra under the direction of Diego Salazar Carreño, a cousin of the former PDVSA head, in a globe-spanning scheme involving front companies in tax havens, Madrid-based El País reported.

Venezuela has taken legal action regarding the money laundering scheme, arresting Diego Salazar Carreño in December 2017 and issuing extradition requests for his alleged conspirators after an investigation found at least 20 people took part in the money laundering. Caracas says over 4.2 billion euros were laundered to Banca Privada d’Andorra through 40 shell companies.

Among those indicted or investigated in Andorra and Venezuela, four formerly well-connected Venezuelan figures opened or acquired offshore firms in Beirut between January and July 2014, during the final months of Rafael Darío Ramírez Carreño’s tenure as president of PDVSA.

From Caracas to Beirut

Prior to opening offshore firms in Lebanon’s capital, Luis Mariano Rodríguez Cabello — allegedly the right-hand man in Diego Salazar Carreño’s money-laundering effort — had already received millions of euros to his accounts at Banca Privada d’Andorra, according to Venezuela’s judiciary.

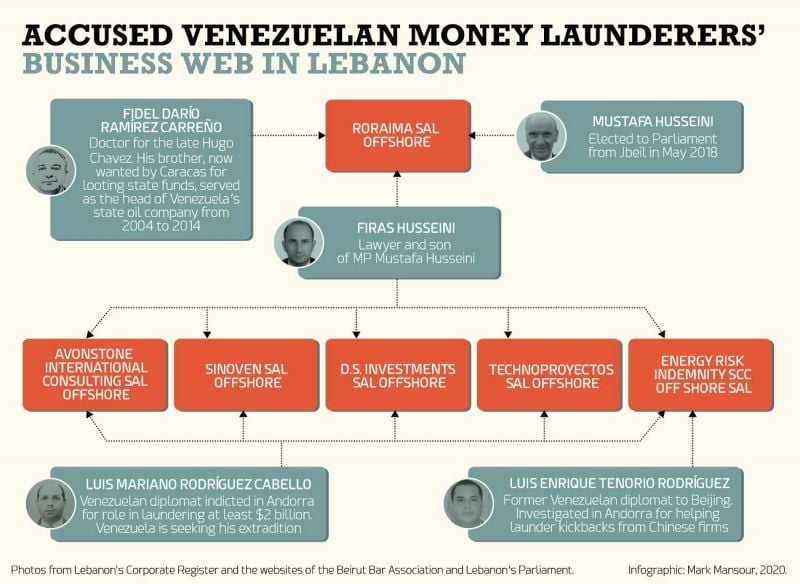

In January 2014, Rodríguez Cabello and Favio Vicente González Ciavaldini, a former PDVSA executive, started the process to establish firms with their lawyer, Firas El Husseini, according to corporate documents obtained by L’Orient Today. Two months later, they formally registered Avonstone International Consulting SAL Offshore, Sinoven SAL Offshore, D.S. Investments SAL Offshore and Technoproyectos SAL Offshore.

Sinoven SAL Offshore was one of the mysterious firms co-founded in early 2014. Photo taken at the Commercial Register in Beirut.

Sinoven SAL Offshore was one of the mysterious firms co-founded in early 2014. Photo taken at the Commercial Register in Beirut.

“I acted as their lawyer. I have no common interest with these people,” Firas El Husseini said, adding that the Venezuelans were referred to him by a colleague.

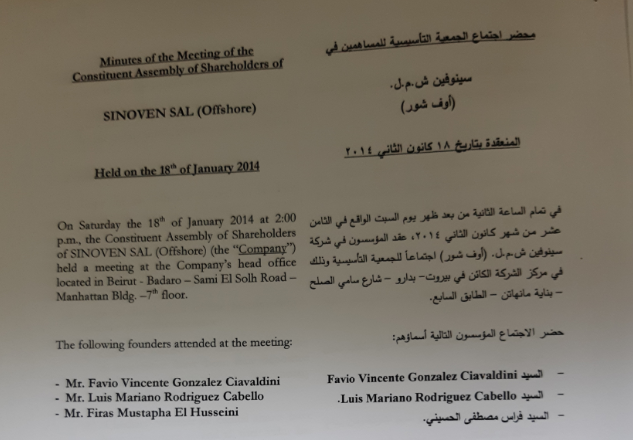

While Rodríguez Cabello was initially nominated as the chief financial officer of these corporate entities, by mid-2014 their boards of directors granted Firas El Husseini, a lawyer on the rolls of the Beirut Bar Association, the power to manage the firms’ finances.

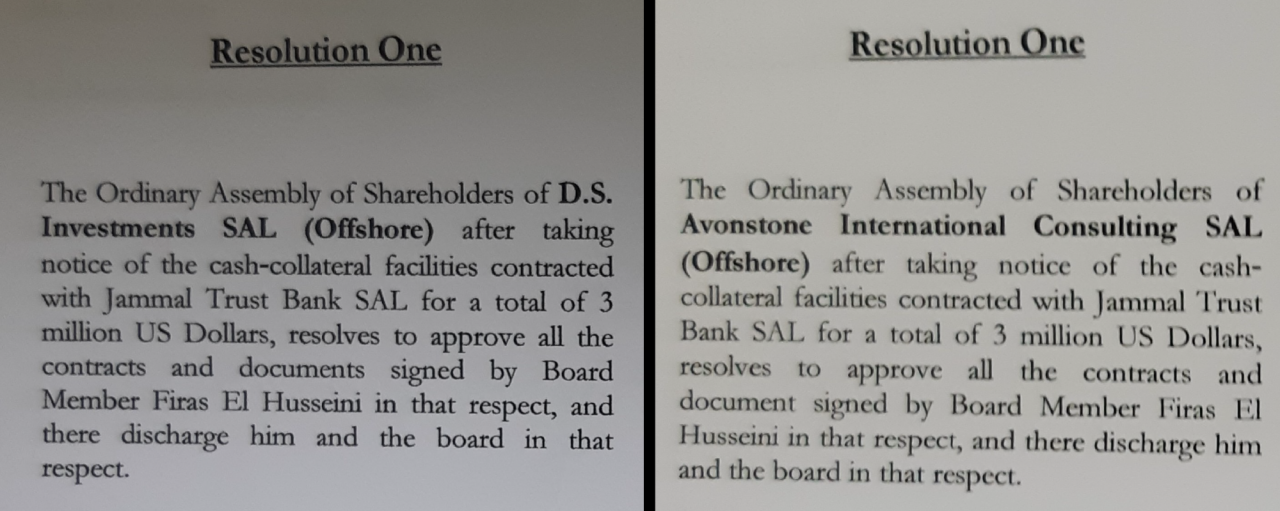

D.S. Investments SAL Offshore was one of the companies in which Rodríguez Cabello was nominated as CFO, before Firas El Husseini, as an attorney, took over signatory powers, as shown in this composite image of documents photographed at the Commercial Register in Beirut.

D.S. Investments SAL Offshore was one of the companies in which Rodríguez Cabello was nominated as CFO, before Firas El Husseini, as an attorney, took over signatory powers, as shown in this composite image of documents photographed at the Commercial Register in Beirut.

According to Firas El Husseini, this is a normal arrangement, whereby the main owners of offshore entities who are not present in the country delegate authority to a proxy.

Under Firas El Husseini’s legal stewardship, D.S. Investment SAL Offshore and Avonstone International Consulting SAL Offshore were extended $6 million worth of cash-collateral services by Jammal Trust Bank, which was liquidated in September 2019 after being sanctioned by the US.

As shown in this composite image of documents photographed at the Commercial Register in Beirut, D.S. Investments SAL Offshore and Avonstone International Consulting SAL Offshore had cash-collateral facilities with Jammal Trust Bank, now defunct, worth millions of dollars.

As shown in this composite image of documents photographed at the Commercial Register in Beirut, D.S. Investments SAL Offshore and Avonstone International Consulting SAL Offshore had cash-collateral facilities with Jammal Trust Bank, now defunct, worth millions of dollars.

Firas El Husseini and Rodríguez Cabello also acquired a pre-existing firm in Beirut, Energy Risk Indemnity SCC Off Shore SAL, in August 2014. This mysterious company shares a similar name to a Caribbean firm, also directed by Cabello, implicated in the money laundering scheme.

The other co-founder in this venture, Luis Enrique Tenorio Rodríguez, served as a Venezuelan diplomat in Beijing in the early 2010s before running afoul of the law. Andorra’s investigation into the money laundering scheme found that Tenorio Rodríguez helped hide Diego Salazar Carreño’s illicit earnings from kickbacks from Chinese companies, El País reported.

A firm in Barbados with a strikingly similar name to the Beirut-based Energy Risk Indemnity SCC Off Shore SAL popped up on Washington’s radar for suspicious money transfers. From October 2014 to November 2015, the Barbadian Energy Risk Indemnity SCC’s business account received over $100 million in suspect wire transfers, according to a leaked report from the US Treasury’s Financial Crimes Enforcement Network.

The transfers to the Barbadian company were believed to have been linked to the Banca Privada d’Andorra money laundering scandal and related to Rodríguez Cabello, the FinCEN report said.

As with its Lebanese namesake, Rodríguez Cabello served on the board of directors of Energy Risk Indemnity SCC up until at least 2016, according to the International Consortium of Investigative Journalists.

The Barbadian company told L’Orient Today that it “has no knowledge of the Beirut-based Energy Risk Indemnity SCC Off Shore SAL,” adding that “there is no connection between that entity and our company.”

All of these Lebanese companies were dissolved and struck from the country’s corporate register between November 2016 and March 2017, after the boards took the decision to wind up the companies in late 2015.

Their Venezuelan owners have since faced legal jeopardy, with Caracas requesting Spain to extradite Rodríguez Cabello. Based on the investigation in Andorra, Venezuela’s judiciary issued findings linking Tenorio Rodríguez and González Ciavaldini to the money laundering scheme at Banca Privada d’Andorra. Rodríguez Cabello was indicted in Andorra in September 2018.

Another firm within the network of offshore entities registered in Beirut has not yet been formally shuttered. Its owners are the most prominent of the curiously connected Lebanese and Venezuelan figures.

Big brothers

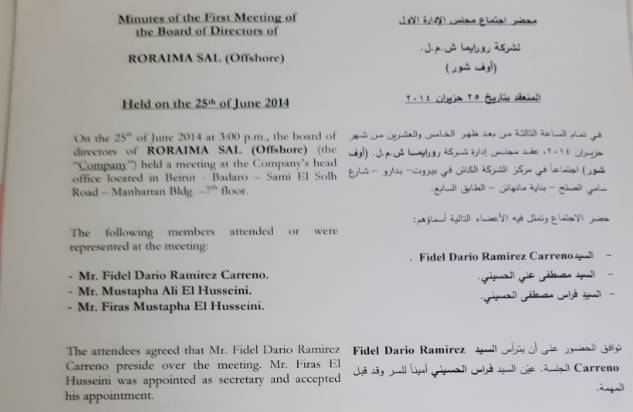

Roraima SAL Offshore was co-founded in July 2014 by Moustafa El Husseini — who was elected to the Lebanese Parliament four years later — his son Firas and Fidel Darío Ramírez Carreño, a doctor of late Venezuelan President Hugo Chávez.

Minutes from a meeting to found Roraima SAL Offshore, which was formally registered in July 2014. Photo taken at the Commercial Register in Beirut.

Minutes from a meeting to found Roraima SAL Offshore, which was formally registered in July 2014. Photo taken at the Commercial Register in Beirut.

The son of a Marxist guerilla, Fidel Ramírez Carreño and his brother Rafael — a close confidante and oil czar of Chavez — rose to high stations in Venezuelan life. In October 2011, Fidel Ramírez took to national TV in the country to deny Chavez had terminal cancer, a claim proven false less than two years later.

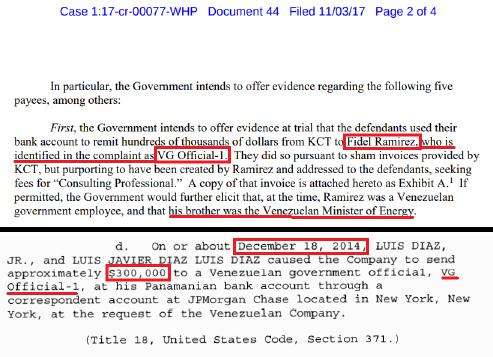

Months after forming Roraima SAL Offshore, Fidel Ramírez Carreño received a money transfer that caught the attention of US authorities. On Dec. 18, 2014, the doctor received $300,000 from two businessmen charged by US prosecutors in the Southern District of New York with laundering money for Venezuelan government officials.

The two businessmen were found guilty in 2018, with the transfer to Fidel Ramírez Carreño’s bank account in Panama serving as evidence, according to court filings reviewed by L’Orient Today. The prosecution alleged the doctor was a government official at the time, without elaborating further what position he held.

In this composite image, a cross-referencing of filings in a US federal criminal case shows Fidel Ramírez Carreño in receipt of $300,000 in December 2014.

In this composite image, a cross-referencing of filings in a US federal criminal case shows Fidel Ramírez Carreño in receipt of $300,000 in December 2014.

Fidel Ramírez Carreño’s brother, Rafael, went on to serve as Venezuela’s ambassador to the UN until November 2017, when he was dismissed from the post. Rafael Ramírez Carreño has turned into a harsh critic of the Nicolás Maduro government, which in turn has issued an arrest warrant for the former PDVSA chief in the money laundering scheme and requested his extradition from Italy.

Fidel Ramírez Carreño’s present whereabouts are unknown. He was linked by Venezuela’s judiciary to the money laundering scheme through Andorra, although he was not indicted in the small principality.

Like Fidel Ramírez Carreño, Moustafa El Husseini’s career is overshadowed by a more prominent brother. The Jbeil MP’s brother, Hussein, was first elected to the Lebanese Parliament in 1972, before becoming the speaker of the legislature in 1984. Hussein El Husseini went on to serve in the high-profile post for eight years and played a key role in brokering the 1989 Taif Accords that brought the Lebanese Civil War to an end. There is no indication that Hussein El Husseini has any connection to the business dealings in question of his brother and nephew.

Unlike Fidel Ramírez Carreño, Moustafa El Husseini’s career improved following the establishment of Roraima SAL Offshore. In May 2018, he landed a seat in Parliament from the Mount Lebanon I constituency of Jbeil and Kesrouan.

Elected on the We Decide electoral list along with Farid Haykal Khazen, Husseini caucuses in Parliament with the Marada Movement. His short tenure in Parliament so far has been rocked by the Oct. 17, 2019, protest movement, which has left MPs scrambling to distance themselves from corruption.

When announcing his support for lifting banking secrecy on Oct. 26, 2019, Husseini invoked the topic of recovering stolen funds. Venezuelan authorities agree, or at least they do in regards to the wealth reportedly moved offshore by the Venezuelans who opened mysterious firms in Lebanon.

Editor’s note: This article was amended to clarify the precise nature of the roles of Firas El Husseini and Moustafa El Husseini in the business ventures in question. After receiving documents post-publication that indicated that Moustafa El Husseini had disclosed his business interests to Lebanese authorities, the article was also modified to specify that the MP did not publicly disclose these ties. Furthermore, a line stating that Moustafa El Husseini’s fortunes improved after establishing Roraima SAL Offshore was changed to say that the MP’s career improved, in keeping with the context and original intent of the passage and in order to avoid any potential misunderstanding regarding his financial fortunes, which remain unknown. This article was also amended to explicitly clarify that there is no indication that Hussein El Husseini has any connection to the business dealings described in the story. L’Orient Today remains committed to giving our readers honest, impartial information and to minimizing potential misunderstandings.